Algorithms May Have Developed Your Favorite Coffee Drink

June 22, 2017

![]() By Ben Schubert, SVP, Nielsen Innovation Practice

By Ben Schubert, SVP, Nielsen Innovation Practice

Most individuals likely don’t spend much time wondering how the products they use every day are developed. Generally speaking, they identify the products that appeal to them and then bring them into their lives without thinking too much about how they came to be—their drinkable yogurt, their antioxidant beverages and their rippled toilet paper.

So unbeknownst to most consumers, tremendous thought goes into developing even the most commonplace products. As a result, product development in the fast-moving consumer goods (FMCG) industry is anything but fast-moving, especially when compared with the technology sector. In reality, it may take an established company two years or more to launch a single product. But before any actual product development takes place, companies spend the first several months asking consumers about ideal features and positioning for possible new products.

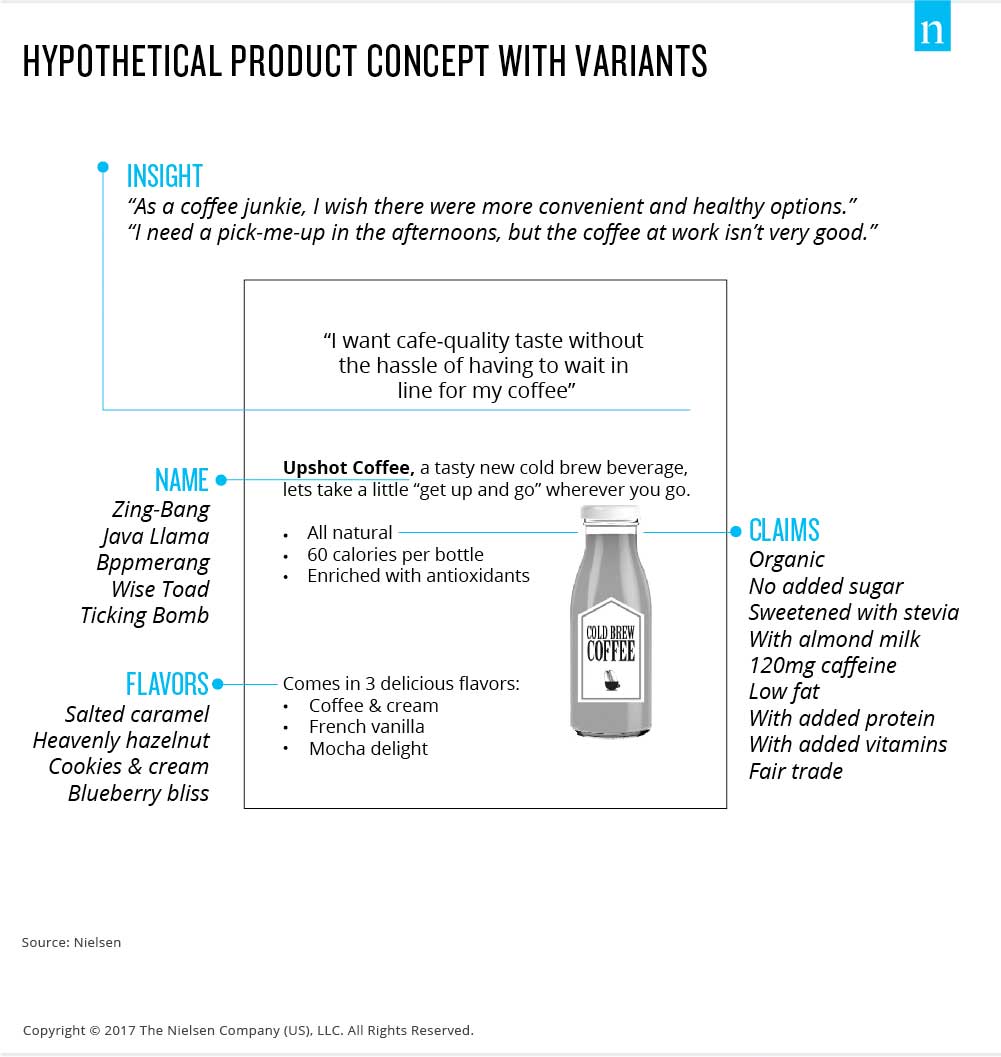

This might seem preposterous. After all, how complicated could it be to launch an ordinary product? The answer is: quite complicated. Take, for example, ready-to-drink coffee, a relatively simple concept. But before you start the production line, here are just a few considerations to think about: Should it include milk or flavor additives? Should it be sweetened? If so, with sugar or zero-calorie sweeteners? Should it be all-natural? How many calories should it have? How much caffeine should it have? Should it be positioned as a “craft” or mainstream coffee? The list goes on.

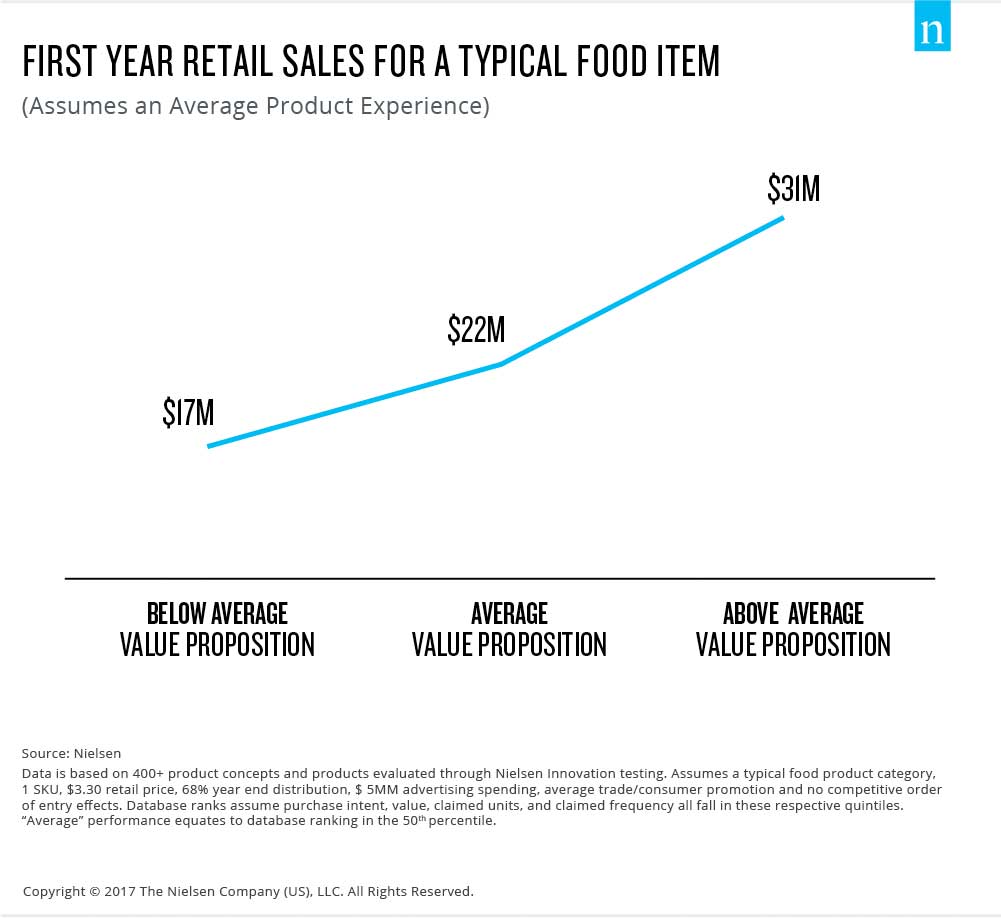

These probably don’t seem like make-or-break decisions but, for established companies, they are all carefully considered—and for good reason. Given that successful FMCG products can earn tens of millions of dollars in sales during their first year in market, an overlooked detail or a positioning bungle can mean millions in lost revenue. New-to-market products rely on strong value propositions that grab consumers’ attention and inspire them to give them a try. And unlike new launches in the technology space, FMCG manufacturers can’t correct serious issues after launch by updating code or pushing a new app version to users. Needless to say, there’s significant pressure to get things right from the very beginning.

THE WAY THINGS USED TO BE—AND MOSTLY STILL ARE

While necessary, the extensive pre-work to develop the ideal product idea is still a time-consuming and often inefficient process. Consider a typical innovation scenario: A beverage manufacturer develops a few “product concepts” that describe the attributes and messaging for a handful of ready-to-drink coffee products. Next, the company uses focus groups or online surveys to see what consumers think about the ideas. Based on the feedback, the company tweaks its product concepts, then test the next round with more consumers. This cycle goes on for quite some time, but in the end, only a relatively small number of ideas will have been tested with relatively small groups of consumers. That means that if the manufacturer’s “starting point” idea was lacking, there’s no guarantee that additional refinements will make it a truly good idea.

THE FUTURE: ITERATION AT SCALE

No longer satisfied with living in the status quo, some tech-savvy manufacturers have started to leverage evolutionary algorithms to optimize their product ideas. This allows them to explore thousands—or millions—of product ideas with a large consumer base over a drastically reduced time period.

Rather than enter tedious test-refine-retest cycles, algorithm-using marketers identify all of the possible attributes they’d like to explore at the outset, including different product names, claims, benefits, ingredients, flavors and more. They then use an online application that dynamically generates a large number of product concept alternatives by combining the elements in the defined “attribute pool” in different ways. For example, 138,600 unique product concepts can be created using the variant options below. The application serves up these concepts two-at-a-time to consumers, then prompts them to choose which one they prefer. Evolutionary algorithms learn from consumers’ responses, which means they progressively “get smarter” and eliminate the least attractive options until the most broadly appealing concepts are identified.

This technology works similarly to popular music streaming applications. Though most users are unaware, each song in a given music database is composed of a distinct combination of variants, such as the gender of the lead vocalist, the degree of melodicism, the presence of a certain instrument, and so on. As a user likes or dislikes individual songs, the algorithm learns which elements (and combinations of elements) the user prefers so that it can recommend increasingly appealing options. However, unlike these applications, concept optimization registers feedback from hundreds or thousands of consumers at once; its goal is to find the most broadly appealing options rather than the most personally appealing ones.

Perhaps not surprisingly, concept optimization works. In fact, Nielsen research has found that concepts identified using evolutionary algorithms generate an average 38% increase in forecasted revenue relative to a brand’s “best guess” concept.

Does this mean that marketers are no longer necessary? Or should they relinquish the task of innovation to their robot overlords? Not at all. As is often the case with data analysis, the quality of the outputs relies heavily on the quality of the inputs—and innovation demands creative inputs. In the context of evolutionary optimization, technology simply removes the barriers to creativity; it allows marketers to explore many more ideas without added risk, cost or time, rather than being forced to whittle their options down to a few safe bets. Bacon-flavored coffee or beer ice cream may sound crazy but, with a million chances to get it right, why not shoot for the moon?