Searching for New Growth? Look to the Shelf [REPORT]

February 7, 2015

![]() We’ve just completed a year of transformation in the retail industry, and looking at 2015, it looks like change will remain constant: Shoppers’ habits are evolving as new consumer markets emerge in developing nations and as the digital revolution changes every industry it touches.

We’ve just completed a year of transformation in the retail industry, and looking at 2015, it looks like change will remain constant: Shoppers’ habits are evolving as new consumer markets emerge in developing nations and as the digital revolution changes every industry it touches.

With change comes opportunity. We know this to be true. But there are opportunities within the familiar as well. Where to begin? At the beginning! Look to the shelf.

The shelf is perhaps the most important link in the value chain from manufacturer to retailer to consumer. It’s where brands and innovations are made available to consumers. It’s where pricing and promotions take place. It’s where supply meets demand, in the most tangible way.

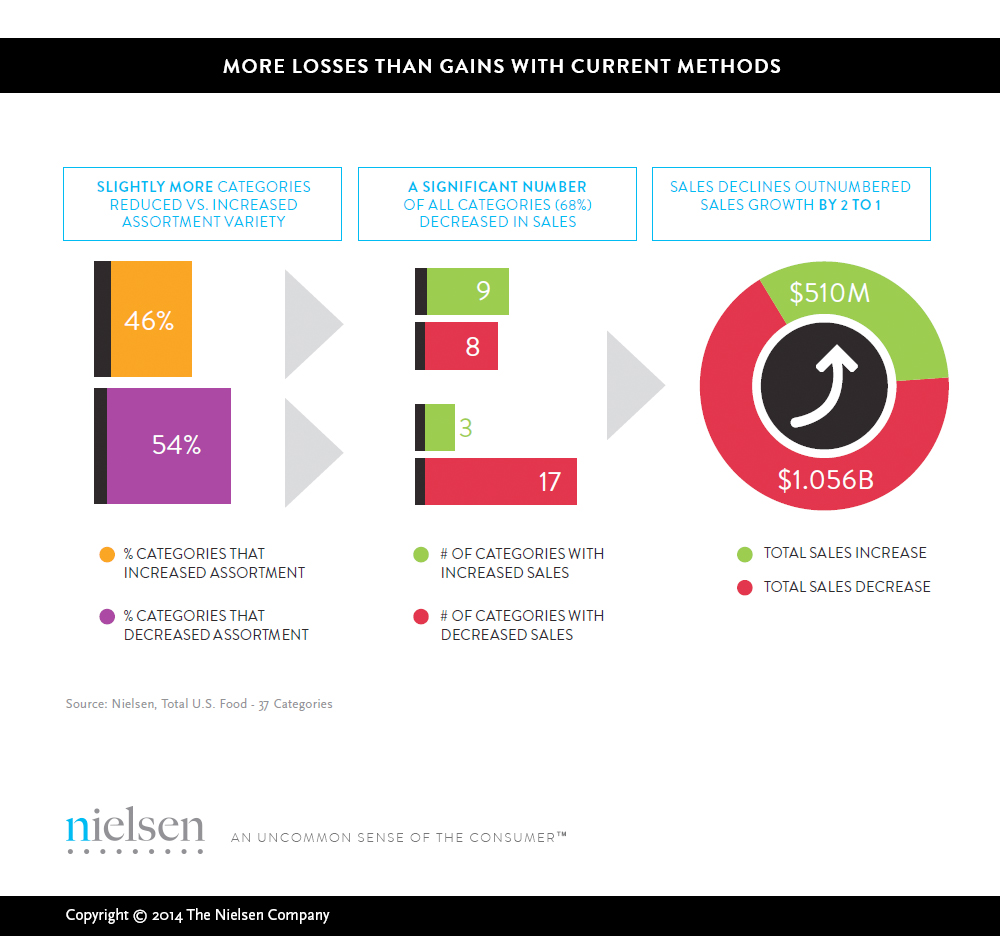

Yet many crucial shelf-space questions are decided based on little more than gut instinct. By using the most precise, up-to-date methods in assortment strategy, retailers and manufacturers can unlock substantial value.

Especially in environments in which it’s difficult to achieve organic growth—as in the U.S. and other developed markets currently—we’re finding that the right assortment strategy can provide a big boost.

To be effective, though, a shift in perspective is required. If you’re judging your product portfolio strictly on velocity—in other words, based on the products that sell the quickest—you’re missing an opportunity.

It’s not just a question of which items are moving. The question to ask is: Are the right items on the shelf in the first place? Incrementality, the measurement of a product’s effect on the entire portfolio, is the key element to fueling a strategy that drives growth.

For example, a Nielsen simulation study that compared two approaches—one that took only velocity into account, and another that integrated both velocity and incrementality—showed that the integrated strategy delivered as much as a 20% improvement in sales.

Understanding incrementality, however, requires that we explore two other concepts: cannibalization and opportunity cost.

With cannibalization, one product steals sales from another product within a brand portfolio—often because they offer the same basic benefits, and they meet the same consumer needs. Opportunity cost is a side effect of cannibalization: It’s the cost associated with having a too-similar item on the shelf instead of another item that offers differentiation.

An item might have high velocity, but if it cannibalizes sales from other items, it does little to grow overall category sales. The opportunity cost of this cannibalistic item is therefore very high and causes the overall category to suffer. If you stock in response to high velocity, you might be creating negative incrementality, and losing money in making the change.

But what about portfolios that are already taking incrementality into account in some way? Regardless of the category, we’ve found that any portfolio can generate greater returns with a more precise strategy.

The first step is to create a detailed picture of exactly how the brand is performing in the marketplace, along with a comprehensive understanding of the brand’s current position in its category. You can then conduct a systematic analysis of areas of opportunity that take incrementality into account. Finally, you can use this deep knowledge to manage your portfolio more effectively to drive growth.

In addition to improving performance overall, a well-planned and well-executed assortment strategy creates mutually beneficial growth for manufacturers and retailers.

Understanding where the category benefits from additional choice, and recognizing space possibilities in areas in which additional items have become duplicative, allow manufacturers to provide strategic direction linked to tactical execution, backed by multiple simulations of “what if” scenarios. The result is greater profit for both the manufacturer and its retail partner, strengthening the relationship.

Nielsen research has found that retailers that implement these kinds of assortment recommendations outpace retailers that do not. In one category example, our research found that total sales grew nearly 400% faster among retailers that put strategic assortment recommendations into action, compared with the total U.S. market.

This is ripe terrain for growth, but it’s important to remember that the spoils go to those who do the hard work. Success requires a connected, end-to-end solution deployed across teams in your organization.

But if you put in the work, you will see results. Dedicating more brainpower to create a smarter, more precise strategy offers serious upside, even in mature markets that present a challenging environment for driving growth.

By Stuart Taylor, SVP, Custom Analytics, Nielsen, and Phil Tedesco, Senior Manager, Assortment, Nielsen

To download report CLICK HERE.