Global Agencies Grew ~4% Organically in 1Q23

May 2, 2023

By Brian Wieser

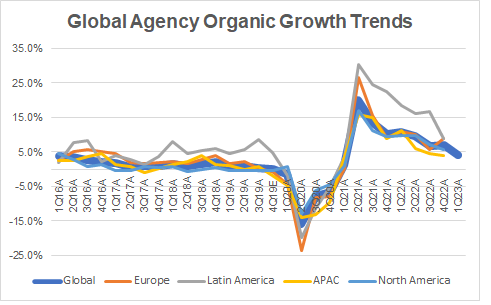

The five largest integrated global agency holding companies have now reported their earnings results for 1Q23, and outcomes were positive across the sector, especially considering the difficult comparables. For the quarter, global organic growth on a year-over-year basis for Havas, Interpublic, Omnicom, Publicis and WPP amounted to approximately 4.0% (although by slightly less if Omnicom’s revenue were recorded in a manner that was comparable to the others, as that company only provides gross revenue rather than net revenue organic growth). Notably, this growth rate was roughly similar to the growth of the smaller – but normally faster-growing and digitally-skewed – private companies I track.

Principal-based trading activity contributed to the outcome, but given the increasingly integral presence of this type of activity in agency business models, it’s certainly an appropriate activity to include in any definition of organic growth. For reference, as-reported, the fourth quarter of 2022 grew by 6.9% and the first quarter of 2022 grew by 10.8%. In general these figures were likely stronger than the growth rates that the broader media industry experienced for reasons I previously outlined.

Source: Madison and Wall, Company Reports

Of course, media was responsible for a disproportionate share of growth, while references to creative agencies generally conveyed persistent weakness.

By region, I estimate that the US business for these agencies was up by around 3.2% in the quarter, slower than the approximately 5.7% growth rate for the fourth quarter but similarly up against a difficult 9.9% comparable in the year-ago period. Europe was relatively stronger with 5.7% organic growth. This figure should be considered as particularly favorable given concerns about greater economic weakness in the region and the 11.0% year-ago growth rate. Latin America was also quite positive with a 9.4% organic growth rate to build on last year’s 18.6% growth rate during the first quarter. APAC was much softer, declining 0.5%, although this region also had a strong 1Q22 (up 11.1%) explaining some of the current period weakness.

Looking towards the rest of the year, guidance remains essentially as it was with most of the agency groups continuing to reiterate organic growth guidance of 3-5%. I see these figures – especially the low end of the range – as generally conservative relative to where they will collectively end the year given comparables in the first half of the year are relatively harder to beat than those in the second half, although conservatism in internal planning isn’t an unwise choice given the risks which are present in the broader economy.