What’s next for women’s sports: Fueling growth by proving value

July 10, 2024

Women’s sports are having more than just a moment. Thanks to a confluence of forces, elite womens’ sports are enjoying unprecedented highs across interest, viewership and attendance.

This is a boon for everyone: the fans who love sports, the brands who want to sponsor them and the arenas and platforms that make the viewing happen. The natural question this raises, how do we keep this going?

Maintaining momentum will hinge on the industry’s ability to show measurable upside for those with skin in the game. And the best news is, it’s already there.

Up and to the Right

While the rise of women’s sports is bigger than any one sport or any one person, it’s undeniable that women’s basketball has been at the forefront of enthusiasm this year.

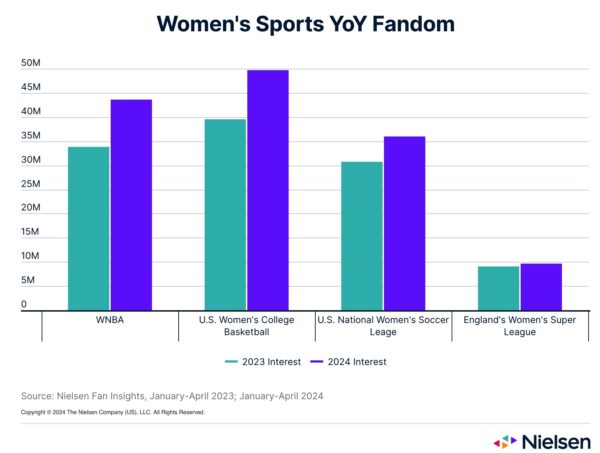

The 2024 Women’s NCAA tournament averaged nearly 19 million viewers (with a peak of 24 million viewers) for the final game between Iowa and South Carolina — up 89% from the previous year and beating viewership for the Men’s final for the first time ever. The 2024 WNBA Draft audience increased 511% and was up 668% with female viewers ages 2-17. And overall interest in the WNBA grew 29% between 2023 and 2024.

Like a rising tide that lifts all boats, this momentum is spreading beyond basketball. The National Women’s Soccer League had a 17% boost in interest between 2023 and 2024. Interest in England’s Women’s Super League jumped 52% after England won the 2022 EURO—thanks in part to a better broadcasting deal, and is still enjoying gains into 2024. On June 11th, Tennis Channel’s T2 channel began dedicating every Tuesday exclusively to women’s tennis matches, a weekly initiative called Women’s Day. And 2024 is predicted to be the year that the global women’s sports industry finally breaks the $1 billion barrier, a 300% increase from 2021.

The audiences are there. The growth is there. And once you understand what’s fueling the success, you can prove the value is there, too.

Value and Values

For years, investment decisions around women’s sports have been largely rooted in DE&I aims. This mindset is important, but it can also be limiting. That’s because women’s sports investments make good business sense. Losing sight of the measurable value undermines its ability to flourish.

Global fans of women’s sports are a diverse group—43% of women’s sports fans are male, and they skew young, are tech savvy and highly engaged consumers. Seventy-four percent of women’s sports fans are the chief income earner in their household, compared to 70% of men’s sports fans. And 57% of women’s sports fans have kids under the age of 18, compared to 53% of men’s sports fans.

Let’s look at the WNBA again. Compared to other sports fans, WNBA fans are much more likely to engage with a brand online, talk about the brand with friends and family and actually make purchases.

These are invested audiences with significant purchasing power—a brand’s dream. This advertising potential should translate into strong media rights deals, but, historically, women’s sports have suffered from undervaluation. Nielsen Sports recently analyzed the value the Women’s Super League delivered through broadcast and found it to be €18.3M. Those rights sold for €7.3M, which means the media rights were undervalued by 2.5x. That’s a problem the right data can fix.

These are invested audiences with significant purchasing power—a brand’s dream. This advertising potential should translate into strong media rights deals, but, historically, women’s sports have suffered from undervaluation. Nielsen Sports recently analyzed the value the Women’s Super League delivered through broadcast and found it to be €18.3M. Those rights sold for €7.3M, which means the media rights were undervalued by 2.5x. That’s a problem the right data can fix.

Sponsorship has always been a crucial revenue driver for women’s sports and when broadcast distribution increases and makes it easier for fans to watch games, the value delivered to sponsoring brands naturally increases as a result. This creates the cyclical growth women’s sports needs, delivering and measuring ROI is driving investment.

In Nielsen’s Driving Value through Women’s Sports Webinar, Google Sports and Entertainment Strategy Lead Molly Beck shared this anecdote: Google wanted to invest equitable spend across men’s and women’s sports and realized they couldn’t. There wasn’t enough women’s sports inventory. “That led us to realize that one of the biggest challenges is visibility,” said Beck. “Google’s sponsorship creates more reach for the League [WNBA], which then improves the return on our investment.”

Maintaining Momentum

Women’s sports are gaining serious traction with desirable audiences. And it’s done so by following its own playbook. When compared to men’s sports, the audiences are different, media consumption is different and fan expectations are different. This makes it a particularly exciting and vital time for everyone to tailor and sharpen their growth strategies

“[Women’s sports] didn’t get here by using the same playbook as men’s sports” – Molly Beck, Sports and Entertainment Strategy Lead, Google

To maintain and grow the momentum around women’s sports, there are four key things brands, leagues and rights holders should prioritize.

1. Improve content access

There’s an industry idiom that says it’s hard to be a fan of women’s sports and it’s hard not to be a fan of men’s sports. Why? Because of content access, content discoverability and content volume. Women’s sports will never get a true shot at ubiquity if games are hidden away on obscure channels, if highlights aren’t shared across popular channels, and if publishers don’t create more spaces for women’s sports content.

- Platforms can solve this by creating more content for fans to consume, easier paths for everyone to find it and embracing a test and learn mindset to identify what truly works for these unique audiences and channels.

- Leagues, Teams and rights holders can solve this by expanding their understanding of who the fans are, why they love the sports and what kind of content they’re looking for now versus historically.

- Brands can solve this by focusing their investment on growing and amplifying women’s sports stories and adding genuine value to the fan experience through consistent and authentic sponsorship.

2. Enhance event experiences

Despite growing enthusiasm for women’s sports, many marquee events are still housed in small and antiquated venues. Take the WSL for example. The 2023-2024 season enjoyed a 43% growth in attendance, with Arsenal breaking WSL attendance records three times and having a higher average attendance than 10 of the Men’s Premier League teams. Yet, only 38% of WSL matches were played at Premier League stadiums. This discrepancy stands in the way of everybody’s growth.

Leagues, teams, rights holders and brands can solve this by investing their activation and marketing spend towards women’s games being played on the biggest stages and delivering the packed and premium event experiences fans want and deserve. content access

3. Develop household names

There are three things that build leagues: Big sports moments, fierce competitions and household names. The athletes can handle the first two, but they need support to build their brands. Growing players into icons is increasingly critical to the fan experience and league visibility.

Leagues, teams and rights holders can solve this by making it easier to be a fan through broad distribution and cross-promotions, giving players the tools they need to create effective content and maintaining a deep understanding of what animates their specific fans.

Brands can solve this by partnering with young talent who have a natural connection to the brand. When done intentionally, these partnerships have the dual benefit of raising the athlete’s profile while deepening the brand’s credibility and status among fans.

4. Measure holistic performance

Budgets are under intense scrutiny and pressure is on to show results across every activation. Data is essential, and it must be comprehensive if you want a true picture of performance. Yes, reach and frequency are important but how effective was the creative? Are you tracking cross-channel engagement? Is overall awareness and consideration trending in the right direction?

You need data at every turn. What’s more, you need committed investment to understand what impact you’re delivering over time. One-and-done campaigns rarely succeed in capturing and optimizing all potential ROI.

- Leagues, teams and rights holders can solve this by understanding the goals of your brand and broadcast partners, measure against the outcomes they want and deliver actionable results to fuel continued testing and learning.

- Brands can solve this by outlining clear goals and objectives and remaining patient and committed to holistically measuring results. True connection and impact takes time and requires a measurement framework that captures the entire partnership across tangible and intangible values.

- When Everybody Wins

In Nielsen’s Driving Value through Women’s Sports Webinar, WNBA Chief Growth Officer Colie Edison closed the conversation out with this: “[Women’s sports] is a microcosm of the broader experiences of women in the workplace: Men are judged by potential, and women are judged by performance. We need to break the cycle that has continued to undervalue women and women’s sports.”

“We need to break the cycle that has continued to undervalue women and women’s sports.” – Colie Edison, WNBA Chief Growth Officer

When women’s sports have the space to shine, support from brands and rights holders and measurement frameworks to capture holistic value, everybody wins.