Understanding Audience Engagement for the Paris 2024 Summer Olympics [REPORT]

July 18, 2024

By Mario X. Carrasco

Excitement is building for the Paris 2024 Summer Olympic Games as over 10,000 athletes from around the world prepare to showcase their incredible talents on this global stage. The City of Light will be teeming with fans and well-wishers who have traveled from near and far to watch and enjoy the Games. Those unable to attend can watch broadcasts on NBC and Telemundo, and networks like USA and the Golf Channel or stream the content on Peacock.

This year’s Games are highly anticipated as they are the first full-capacity Olympics since the pandemic began. However, consumers’ media consumption habits changed significantly during the pandemic. To understand how audience engagement with the 2024 Summer Olympics might be impacted, ThinkNow conducted a quantitative research study among a nationally representative sample of U.S. adults.

Download the Audience Engagement: Paris 2024 Summer Olympic Games Report here.

Consumer Sentiment

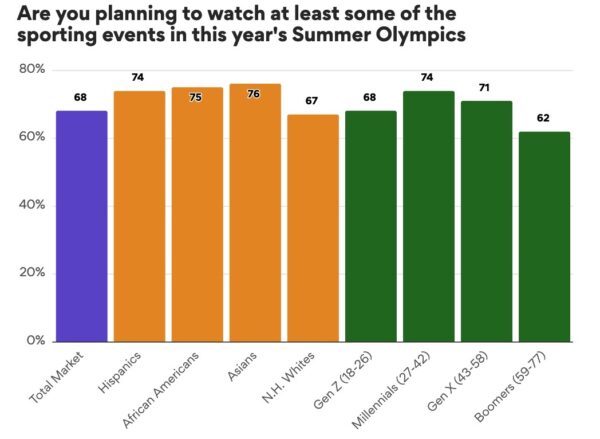

The study revealed that a significant majority (68%) of U.S. adults plan to watch at least some of the Summer Olympics, marking a rise in enthusiasm compared to previous Games. This is particularly exciting considering fewer than half watched the 2022 Winter Olympics and 2020 Summer Olympics.

Asians (76%) expressed the most interest in watching this year’s Games, followed by African Americans (75%), Hispanics (74%) and non-Hispanic Whites (67%), demonstrating the growing diversity of U.S. viewers of this year’s Games.

Millennials (74%) are the largest generational cohort expressing interest in the Summer Olympic Games, followed by Gen X (71%) and Gen Z (68%). At 62%, Boomers show the least interest. That means that this year’s viewers will not only be more diverse but also skew younger, an important insight for brands looking to get in front of these influential groups.

Viewership

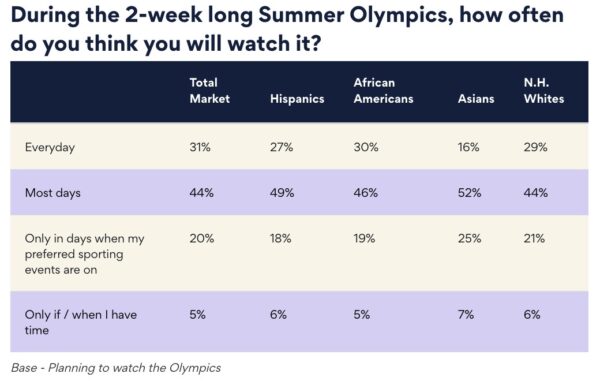

The study also uncovered distinct differences among various demographic groups in viewership patterns. Overall, 31% of viewers plan to watch the Olympics every day, with African Americans (30%) and non-Hispanic Whites (29%) close to the average, while Asians show less daily viewership at 16%. A significant portion of the audience plans to watch the Games on most days, with Asians leading at 52%, followed by African Americans (46%), Hispanics (49%), and non-Hispanic Whites (44%). Asians (25%) are more likely to view the Olympics only on days when their preferred sporting events are on, compared to 21% of non-Hispanic Whites and 18% of Hispanics.

Motivations and Preferences

Consumers plan to watch the games for various reasons, with the primary motivations being a love for their favorite sports, a sense of patriotism and a desire to gain cultural understanding. Gymnastics appeals to all groups, with Asians showing the highest interest at 52%. Basketball is particularly popular among African Americans, with 59% expressing interest. Swimming attracts a higher percentage of Asians (29%) and non-Hispanic Whites (27%), while Track and Field is favored by African Americans (38%).

Baseball sees notable interest among Hispanics (23%) and non-Hispanic Whites (23%) despite not appearing at the Olympic Games this year. The sport returns for the 2028 Summer Olympics in Los Angeles. Beach Volleyball is most popular among non-Hispanic Whites (26%), whereas Boxing finds more favor among Hispanics (25%). Soccer is especially popular among Hispanics, with 35% expressing interest, significantly higher than other groups. The study also revealed varied levels of enthusiasm and engagement among different demographic groups and generations. Overall, 45% of respondents completely agree that watching the U.S. compete in the Olympics fills them with pride. This sentiment is strongest among Hispanics (53%) and Baby Boomers (57%), while African Americans (40%) and Gen Z (35%) show less enthusiasm. The anticipation for the Olympics every four years is high, with 34% of the total market expressing strong agreement, particularly among Hispanics (43%) and Baby Boomers (47%). Thirty-nine percent of respondents view new sports like Surfing and Skateboarding favorably, with Millennials (47%) showing the most support and Boomers being the least enthusiastic (19%).

Learning about the culture of the host country is an appealing aspect for 43% of viewers, especially Gen Z (48%), although Asians (30%) and Boomers (26%) expressed less interest in diverse cultures. A significant portion of respondents, led by Hispanics (33%) and Millennials (35%), often go out of their way to watch their favorite Olympic events, with African Americans (17%) being less likely to do so.

The Olympics also serve as a family bonding occasion for 31% of viewers, particularly among Millennials (35%), though Boomers (20%) are less likely to share this view. A significant portion of respondents plan to share Olympic content on social media, with Gen Z (28%) being the most active and Boomers (9%) being the least.

Media Consumption

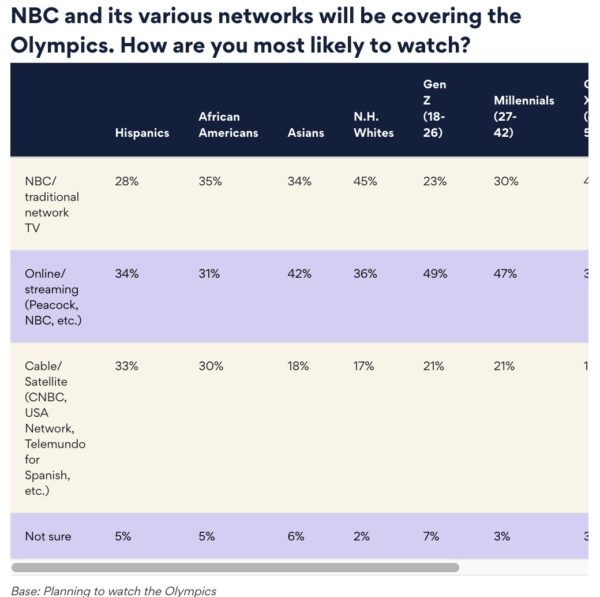

Finally, different demographic groups and generations show notable differences in media consumption habits. Non-Hispanic Whites (45%) and Baby Boomers (54%) are more likely to watch the Olympics on NBC/traditional network TV compared to Hispanics (28%) and Gen Z (23%). Online streaming platforms such as Peacock and NBC.com are particularly popular among Asians (42%) and Millennials (49%), indicating a preference for digital consumption among younger audiences. In contrast, cable/satellite options like CNBC, USA Network, and Telemundo are favored by Hispanics (33%) and, to a lesser extent, by Baby Boomers (26%).

A small percentage of viewers across all demographics are unsure about their viewing method, with Asians (6%) and Gen Z (7%) showing slightly higher uncertainty. These trends highlight the shift towards digital streaming among younger generations and the continued preference for traditional TV among older viewers.

Summer Olympics Key Takeaways

As technology continues to reshape how audiences engage with major events like the 2024 Summer Olympics, these findings underscore the importance for broadcasters and organizers to adapt their strategies to cater to consumers’ diverse viewing habits and preferences across different age groups.

To download report, CLICK HERE.