Tops of 2024: Sports

January 14, 2025

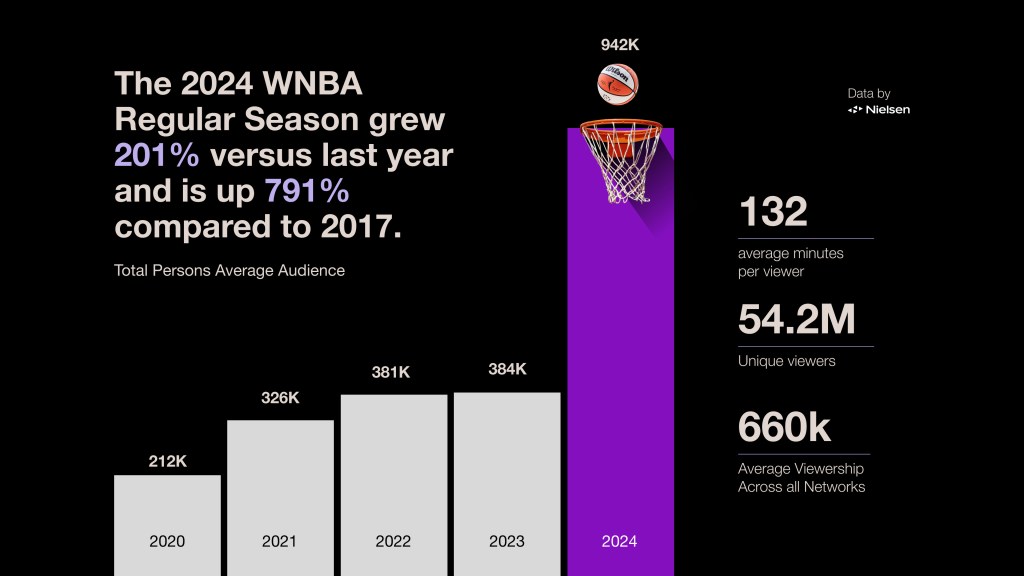

1. The WNBA sets new records

There’s been growing fan momentum around women’s sports for a few years now, and basketball has been at the center of it. The WNBA and Women’s College Basketball have both seen growing interest among U.S. adults this season. The WNBA has experienced the largest growth, with interest in the league increasing by 29% year-over-year according to Nielsen Fan Insights. As star athletes like Caitlin Clark, Angel Reese and Cameron Brink have made a name for themselves in college, excitement is clearly carrying over to the start of their professional careers this year.

WNBA regular season coverage across Disney channels and ION averaged 942,000 viewers, a 201% increase over the prior season. Even when including NBA TV games, the 660,000 total audience average was markedly higher than previous years. And compared to 2017, a low point in viewership for the league, 2024 was up nearly 800%.

All data is live plus same day, panel-only, reach based on one minute qualifier.

Beyond the regular season, the WNBA All-Star game in July was the most watched ever, drawing 3.4 million viewers, and the finals between the Minnesota Lynx and New York Liberty reached 13.8 million unique viewers across five games. It was the most-watched final series in 25 years.

While the league was already on an upward trajectory in terms of viewership, one has to wonder if the NIL (Name, image and likeness) era of college sports has helped super charge these young athletes’ social presence and increase interest in the game. The good news for brands looking to tap into and support this rise in popularity is that investments in women’s basketball can pay off. Compared to other sports fans, WNBA fans are much more likely to engage with a brand online, talk about the brand with friends and family and actually make purchases, and 60% of WNBA fans are likely to recommend a brand sponsor to others1.

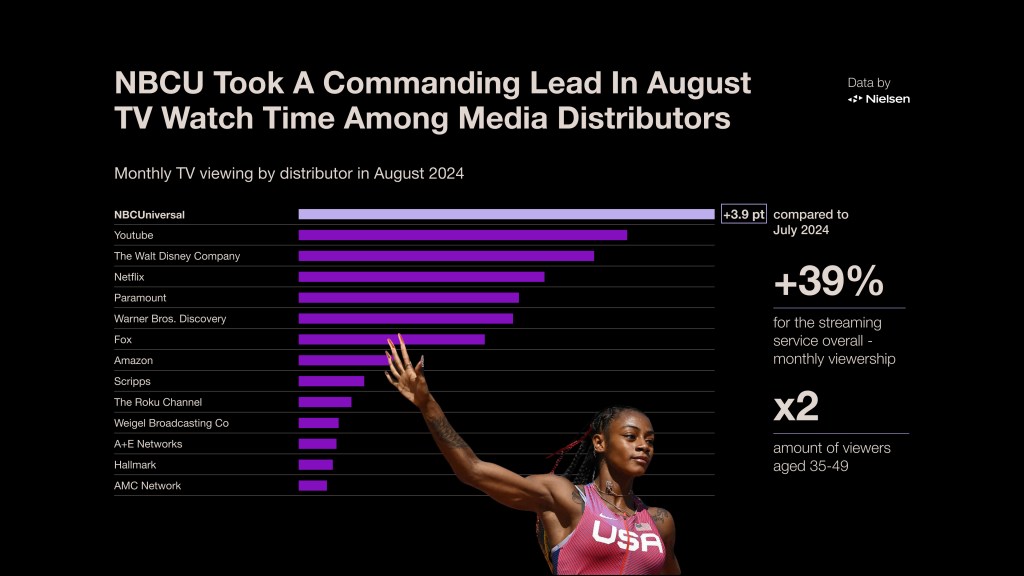

2. NBCU establishes a new standard for major event coverage with the 2024 Paris Summer Games

NBCUniversal went big with its coverage of the 2024 Paris Summer Games–really big. With 7,000 hours of coverage and all events running live on Peacock, it set a new standard for what was possible with major multi-event competitions. And, it paid off. NBC’s primetime coverage was up 13% compared to Tokyo even though it was not live.

And, looking at our August 2024 Media Distributor Gauge, NBCUniversal added a stunning 3.9 share points compared to July thanks to its Olympic coverage. Peacock, meanwhile, saw a 39% bump in viewership and doubled its adult 35-49 audience month-over-month.

Publishers aren’t the only ones benefiting from sporting events such as the Olympics; the games are a powerful example of the impact that long-range sports partnerships can have on brand awareness. With a decades-long sponsorship of the Olympics, Visa saw 49% of U.S. consumers aware of its association with the sporting event in May 2024 ahead of the 2024 Paris Summer Games, a 12-point increase from 37% ahead of the Tokyo Games in 2021, according to Nielsen Fan Insights.

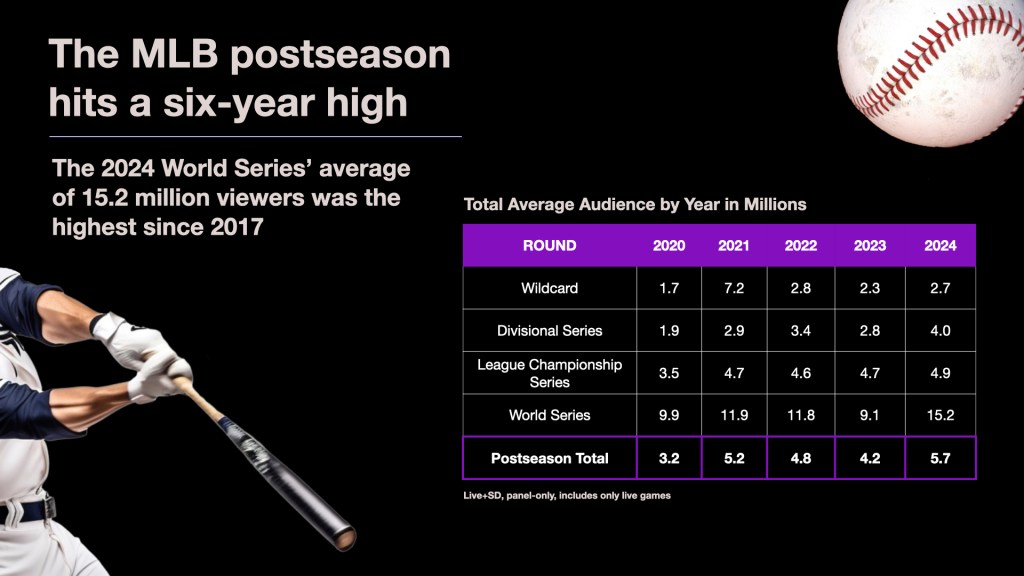

3. The MLB postseason hits a six-year high

As Major League Baseball’s regular season wrapped and the playoffs began, fans were treated to a little bit of everything in terms of storylines. You had underdogs the New York Mets and Detroit Tigers completing remarkable turnarounds to nab their places in the Wildcard round. Then you had powerhouses the L.A. Dodgers and New York Yankees, the number one seeds from each league and home to some of the biggest stars in baseball.

The result: every round of the playoffs saw increased viewing compared to 2023, with the Divisional round achieving its highest average audience since 2015. The Mets and Dodgers were particular draws.

Ultimately, it would be the Yankees and Dodgers who faced each other in the World Series for the first time since 1981, reigniting one of the biggest rivalries in the game’s history. Beyond the legacy, the matchup featured American and National League MVPs Aaron Judge and Shohei Ohtani, and of course, the top two TV markets in the country.

The 2024 World Series’ average of 15.2 million viewers was the highest since 2017 and propelled the postseason as a whole to its best total since 2019. There’s no question, it was a win for Disney, Warner Bros. Discovery, and Fox, who shared carriage of the postseason. In Fox’s case, it helped propel them to a big October, in which they gained 1.1 share points in our Media Distributor Gauge.

Live+SD, panel-only, includes only Live games

4. Brand opportunities abound in baseball and basketball

As viewers tuned in to baseball in record numbers, brands also benefited through sponsorships. In total, the top 10 most valuable sports sponsorship assets delivered almost $340 million in media value for brands in 2024, and all 10 opportunities in terms of sports sponsorship value came from either the MLB or the NBA. In particular, teams that make it to the finals can create significant media value for brands sponsoring them. The L.A. Dodgers, winners of the 2024 World Series, saw player jersey patch sponsorships and field-level branding earn top spots, while this year’s NBA Final winner the Boston Celtics ranked for on court branding.

Much of this simply reflects the amount of airtime MLB and NBA sponsorships get due to the amount of games played, compared to NFL games for example. As a result, MLB jersey patches and NBA on court signage are some of the most valuable team partnerships within sports.

5. Streaming gains an increasing share of major sports

We’ve already touched on the substantial role Peacock played in NBCU’s coverage of the 2024 Summer Games, but it’s part of a larger trend of live sports shifting toward streaming platforms. Beyond simulcasting games that may be airing on broadcast or cable, there is an increasing number of major events that are exclusively streamed.

Prime Video’s coverage of NFL Thursday Night Football games is the standard bearer on this front, and it set the stage for the rights negotiations and programming strategies that came after it. Shortly after Amazon scored the exclusive rights to TNF, the NHL signed a new deal with Warner Bros. Discovery that included streaming rights for Max via its Bleacher Report sports add-on.

Peacock carried an exclusive Friday night NFL game from Brazil in week one of the current season. ESPN+ carried an exclusive Monday Night Football game in week seven. And Netflix scored the rights to stream the two NFL Christmas games this year and at least one over the next two seasons.

Last but certainly not least, the NBA signed its latest round of rights deals this summer, which includes an 11-year exclusive deal with Prime Video to stream 66 regular season games and all the knockout rounds from the league’s in-season tournament. And, notably, considering the first item on our list, the deal also includes an 11-year term to carry WNBA games starting in 2026.

Our recently accredited first party data methodology, part of the larger big data + panel solution, is primed to measure live streaming. Using that metric to look at Thursday Night Football this season, Prime Video is averaging 14.3 million viewers, up slightly from last year. And Peacock’s first exclusive game pulled in 14.0 million. It’s clear that sports on streaming is succeeding and can continue to do so.

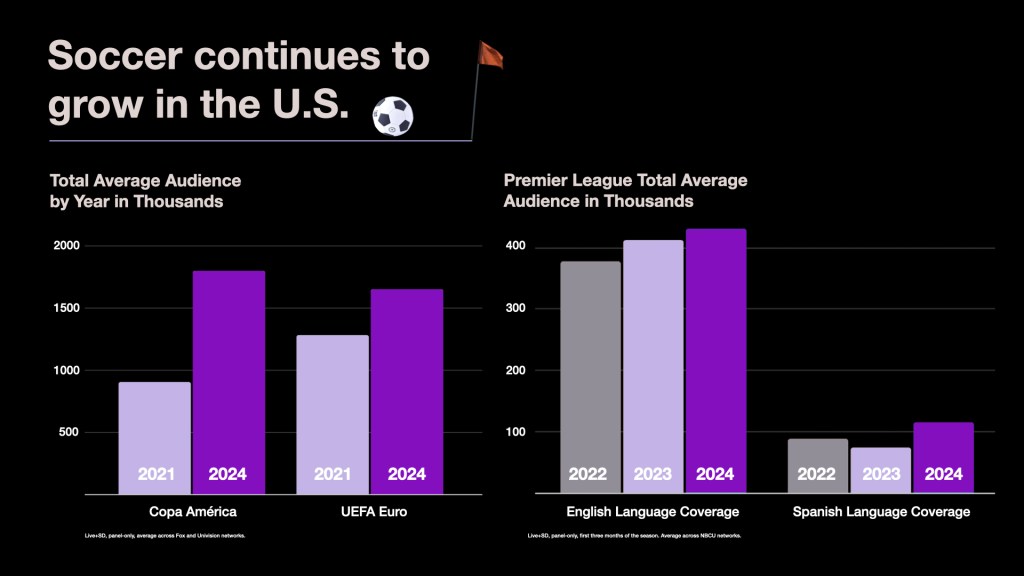

6. Soccer continues to grow in the U.S.

In addition to the Olympics, sports rights shifts, and all the other hype around the sporting world this year, this was also a notable year for the world’s favorite game here in the U.S.

First, there was the inaugural edition of the CONCACAF W Gold Cup, which was held in the U.S. and featured teams from North, South and Central America. The U.S. women’s team ultimately emerged victorious in the final match against Brazil. Most of the matches were exclusively streamed (further making the case for good live streaming measurement).

Then in June, there were two major tournaments: Copa Amèrica and the UEFA European Championship (Euro). It was the first time both were held since the pandemic-delayed editions in 2021, and only the second time the former was held in the U.S. Both saw increases in their total audiences compared to the previous tournaments, with Copa América nearly doubling its audience across Fox and Univision networks. The Euro was carried by the same channels and saw a bump of 29%.

Though the stakes may be a bit lower than a quadrennial tournament, the English Premier League has slowly but surely been making inroads with American audiences. The current season to date marks the high point of a three-year growth trend, and though Spanish language coverage has taken a bumpier road, the signs are there that Hispanic audiences are embracing it too. NBCU is reportedly pushing for some matches to be played in the U.S. in the future, which could further boost interest.

7. Football wins U.S. viewers’ attention

As we saw last year, the NFL continues to dominate in terms of viewership in the U.S., with 519.4 billion minutes watched over the past year. And football continues to command some of the biggest sports programming moments in the U.S.

In fact, the NFL led viewership at the program level, with all top 10 U.S. sports programs comprising the 2023-2024 season NFL Super Bowl and playoff games. Super Bowl LVIII, featuring the Kansas City Chiefs and the San Francisco 49ers, had the largest TV audience for a single-network telecast to date at 123.7 million viewers. Not only did the game go down to the wire in overtime to keep viewers engaged, it also saw hype leading up to the event with Usher headlining the halftime show and superstar Taylor Swift making an appearance to cheer on Chiefs’ tight end, Travis Kelce. So it’s not surprising that the game took the spot for most watched sports program in 2024.

This year’s big game also helped lift viewing in local markets, with February 2024 seeing 432.7 billion minutes across 56 local TV markets in the U.S.—that’s equivalent to 823,334 years spent watching TV. And despite their teams losing in the playoffs in January, residents of Houston and Buffalo respectively watched 9% and 31% more minutes of local TV during February 2024 compared to the same month in 2023.

8. Stars power teams’ social media value

As the Super Bowl demonstrated, stars have the power to attract audiences, including on social media. This year, we once again saw Inter Miami CF, where Lionel Messi plays, top the list for U.S. sports teams by social media value. Several other teams on the list also featured well-known players. Having a global star player on a team typically leads to a higher follower count and higher interaction rate as well. For brands looking to collaborate with sports teams, finding the right team will require considering the players as well.

2024 was an all star year for sports. As we look ahead to 2025, sports should continue to prove a valuable way of connecting with audiences. Doing so successfully requires meeting audiences where they’re watching and identifying the right leagues, teams and players for your platform or brand.

Notes:

1Nielsen Fan Insights