Healthcare and Pharma Digital spend Rises, but Outlays stay Low

October 15, 2013

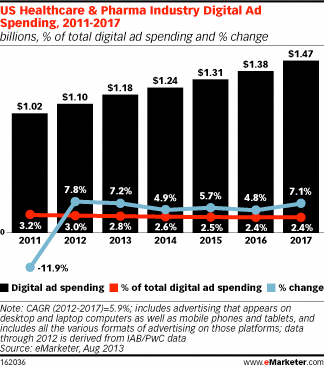

![]() Advertising spending on paid digital media by the US healthcare and pharmaceutical industry will hit $1.18 billion in 2013 and rise to $1.47 billion by 2017. Though spending is growing quickly in some less-regulated sectors of the healthcare industry, continued privacy concerns, regulatory uncertainty around prescription medicines and patent expirations for blockbuster drugs will continue to put a damper on pharmaceutical-related investments.

Advertising spending on paid digital media by the US healthcare and pharmaceutical industry will hit $1.18 billion in 2013 and rise to $1.47 billion by 2017. Though spending is growing quickly in some less-regulated sectors of the healthcare industry, continued privacy concerns, regulatory uncertainty around prescription medicines and patent expirations for blockbuster drugs will continue to put a damper on pharmaceutical-related investments.

eMarketer estimates that healthcare and pharmaceutical marketers—including marketers of prescription and over-the-counter products, facilities, services, research, healthcare professionals, hospitals and biological products, as well as establishments providing healthcare services and social assistance for individuals—will invest 54% of their paid digital dollars in direct-response efforts this year. The remaining 46% will be invested in branding-focused campaigns. Search and display will command the largest chunks of digital spending, with growth expected in the areas of mobile, local, video and native advertising.

eMarketer estimates that healthcare and pharmaceutical marketers—including marketers of prescription and over-the-counter products, facilities, services, research, healthcare professionals, hospitals and biological products, as well as establishments providing healthcare services and social assistance for individuals—will invest 54% of their paid digital dollars in direct-response efforts this year. The remaining 46% will be invested in branding-focused campaigns. Search and display will command the largest chunks of digital spending, with growth expected in the areas of mobile, local, video and native advertising.

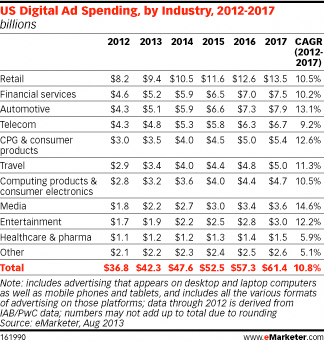

Among industries individually tracked by eMarketer, the healthcare and pharma industry spends the least on paid online and mobile media, and growth is expected to remain sluggish over the next several years. eMarketer’s current forecast anticipates that the healthcare and pharma vertical will remain in last place when ranked by digital ad spending per industry through 2017.

Among industries individually tracked by eMarketer, the healthcare and pharma industry spends the least on paid online and mobile media, and growth is expected to remain sluggish over the next several years. eMarketer’s current forecast anticipates that the healthcare and pharma vertical will remain in last place when ranked by digital ad spending per industry through 2017.

Moreover, eMarketer expects the healthcare and pharma industry’s share of total US digital advertising to fall from 2.8% in 2013 to 2.4% by 2017.

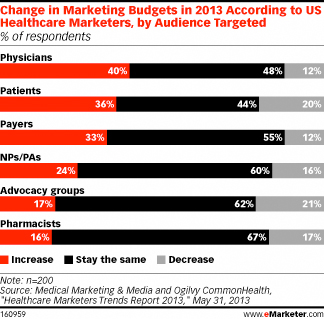

At the same time, however, pharma marketing targeted to healthcare professionals is on the rise. An April 2013 survey of US healthcare marketers from Medical Marketing & Media and Ogilvy CommonHealth found that an average of 75% of healthcare marketing budgets were allocated to reaching healthcare professionals; only 25% were aimed at consumers. The same study found that 40% of respondents planned to increase marketing targeted at physicians in 2013, compared with 36% who planned to increase patient-focused spending.

At the same time, however, pharma marketing targeted to healthcare professionals is on the rise. An April 2013 survey of US healthcare marketers from Medical Marketing & Media and Ogilvy CommonHealth found that an average of 75% of healthcare marketing budgets were allocated to reaching healthcare professionals; only 25% were aimed at consumers. The same study found that 40% of respondents planned to increase marketing targeted at physicians in 2013, compared with 36% who planned to increase patient-focused spending.

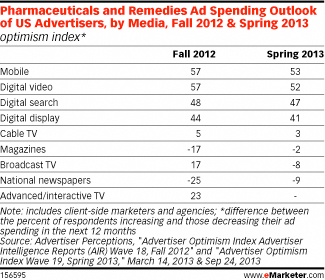

Despite the current situation—and a majority of direct-to-consumer (DTC) spending still being pumped into broadcast and print media—most studies indicate that US advertising and marketing execs in the healthcare and pharma industry are more bullish on increases in digital advertising than on traditional tactics. A fall 2012 study by Advertiser Perceptions asked a sampling of these professionals whether they planned to increase or decrease their ad spending in specific media in the next 12 months and then calculated the difference between percentages. The study’s resulting “optimism index” showed the highest numbers for most digital media, indicating more intent to increase spending. Indexes for traditional print media, such as magazines and newspapers, were negative.

Despite the current situation—and a majority of direct-to-consumer (DTC) spending still being pumped into broadcast and print media—most studies indicate that US advertising and marketing execs in the healthcare and pharma industry are more bullish on increases in digital advertising than on traditional tactics. A fall 2012 study by Advertiser Perceptions asked a sampling of these professionals whether they planned to increase or decrease their ad spending in specific media in the next 12 months and then calculated the difference between percentages. The study’s resulting “optimism index” showed the highest numbers for most digital media, indicating more intent to increase spending. Indexes for traditional print media, such as magazines and newspapers, were negative.

Courtesy of eMarketer