Agencies’ Reversal of Fortune Explained

February 25, 2023

By Brian Wieser / Madison & Wall

The largest agency holding companies have now reported their full year earnings results for 2022, and outcomes were, for the most part, very good. There has been a perception over many years among that agencies were poised to experience secular decline. Needless to say, I didn’t agree then and continue to believe that significant opportunities remain ahead for the industry.

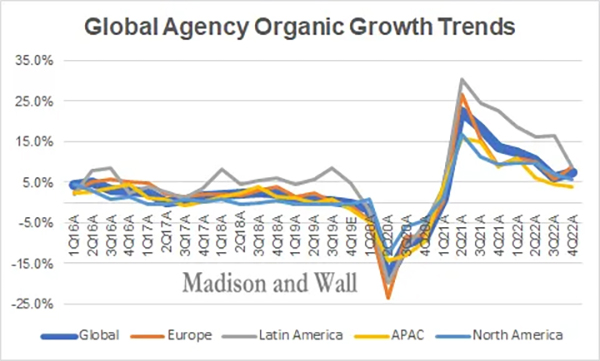

For the fourth quarter of 2022, organic growth for the industry’s five biggest players (excluding Accenture, whose Song division does not provide consistent disclosures and generally has different revenue streams relative to WPP, Publicis, Omnicom, Interpublic and Dentsu) was approximately 7%, very similar to the third quarter’s outcome. This was slower than what we saw during the first half of the year (an 11% gain in both of those quarters), but still strong on a relative basis, especially given difficult comparables. For the year growth for the group amounted to 9%, which built upon a 13% organic gain during 2021.

Thanks for reading Madison and Wall! Subscribe for free to receive new posts and support my work.

Although that year’s result was aided by the easy comparables of 2020 (when the group fell 8%) trends in both years reflected a genuine rebound for the industry vs. the years immediately preceding the pandemic. In 2017, growth was 1.1%, followed by growth of 2.2% in 2018 and 0.3% in 2019. On an inflation-adjusted basis, growth in 2022 – and, arguably, the incremental growth in 2021 relative to 2020’s decline – more closely resembled rates of expansion experienced during most years immediately preceding and following the global financial crisis during the period between 2004 and 2014.

Source: Madison and Wall, Company Reports. Global totals include WPP, Publicis, Omnicom, Interpublic and Dentsu, regional totals include Havas through 3Q22 but exclude Dentsu to better facilitate comparability.

What are the factors that explain this reversal of fortune?

Much of the industry’s growth in the first part of the century was an immediate outgrowth of consolidation, especially within media agencies where digital advertising was a key factor. As I wrote in 2014, the complexity of the digital advertising meant it was a good business in which to get paid by the hour. Globalization of large brand owners and rapid expansion in countries including China, Brazil and India helped, too, as did share gains from most single country-focused or independent agencies.

But in the five years preceding the pandemic, growth slowed significantly. Certainly there was heightened scrutiny on media agencies after 2016 which may have contributed to the slowdown in North America (where there was essentially no growth between mid-2016 and early 2021), there was aggressive cost cutting by marketers pursuing zero-based budgeting strategies and a recognition that traditional ad campaigns with a small number of expensive creative assets were less preferred vs. campaigns with a large number of cheap creative assets. Some in-housing of media and creative activities was probably also a factor, if a modest one.

While traditional services continue to experience mixed outcomes, with many creative agency businesses’ legacy offerings struggling and media agency businesses generally thriving, and while like-for-like clients continue to seek efficiencies in every part of their supply chain (and, to be clear, agencies are definitively supply chain businesses in the eyes of many clients), there are several important incremental growth drivers to point to.

First, it’s important to acknowledge that inflation has been a factor in the past couple of years. Most large brands manage their budgets for most things related to advertising with an eye towards the percentage of revenue they account for. Agency services then see a percentage of that spending. High levels of inflation in a world that doesn’t experience a recession means more revenue for marketers, which in turn means more spending on advertising and more spending on agencies.

More importantly (and more durably), there are many relatively new large businesses rooted in the technology industry who are likely continuing to scale up their spending on external services as they mature. Agencies’ newer offerings related to data and business transformation are also undoubtedly driving revenue growth, as these are critical areas of focus for agencies’ primary clients. As time progresses, these activities offer the potential for agencies to more meaningfully broaden their client bases to include individuals not presently overseen by chief marketing officers. Finally, expanding principal-based trading solutions and other managed services offered by agencies are also becoming increasingly important across the industry, as marketers – now better versed in the pros and cons of such products – seem increasingly willing to embrace them.

The world’s five largest agencies presently only generate slightly more than $50 billion in annual revenue. If we assume they account for between a third and half of all spending on agencies, this would imply $100-$150 billion in global spending on agency services. Such a number remains relatively modest in context of a global marketing industry measured in trillions of dollars, which highlights the potential for significant opportunities ahead to agencies who pursue them.