Consumer Products Report 2024: Resetting the Growth Agenda

March 12, 2024

By Richard Webster and Charlotte Apps

The consumer products industry is used to finding a way through periods of uncertain demand. In the last couple of decades alone, unflappable executive teams have steered consumer packaged goods companies (CPGs) through two of the most unstable periods of modern times: the 2007–08 global financial crisis and the Covid-19 pandemic.

The uncertainty CPGs face in 2024 feels different, though, chiefly because executive teams have fewer levers to pull in response to faltering consumer confidence than they had during past inflection points for the industry.

Price increases implemented in 2023 in response to dramatic cost inflation are just one constraint. The room for maneuvering is also being limited by tight labor markets, high capacity utilization, and the ending of the era of ultra-low interest rates. The success of past efficiency drives means there are fewer cost-saving opportunities, too; overhead costs are meaningfully lower than in 2008.

Such is the setting for Bain & Company’s first annual Consumer Products Report, which we hope will assist the industry in formulating a new playbook for the months ahead. We surveyed more than 120 senior consumer products executives around the world on their experience in 2023 and their strategic priorities this year.

It’s clear that restoring profitable, volume-led growth is now the mission. But questions abound. Is a return to volume growth in developed markets possible, or will emerging markets become the critical battleground? How will the growth imperative shape the next frontier of digital capabilities? What’s the best way to make real progress against sustainability goals and thereby create a new platform for long-term growth?

In this report, we first examine how 2023 has left the industry at a crossroads, then explore the connection between profitable growth and positive stakeholder impact. We conclude by looking ahead to the most pressing issues that will shape CPGs’ strategic agendas in 2024 and beyond.

Confronting a harsh pricing paradox

The consumer products sector has enjoyed another year of tremendous growth, but there are telling signs that CPGs need to rewrite their growth playbooks.

We estimate that retail sales value (RSV) for the industry globally rose by close to 10% year over year in 2023 (see Figure 1). That surge follows a similar rise in 2022 and is nearly double the 10-year average growth rate. Yet three-quarters of 2023’s growth is likely to have come from price increases rather than volume gains, as CPGs passed on rising input costs to consumers. In the US and Europe, price increases accounted for 95% of RSV growth. That imbalance isn’t sustainable.

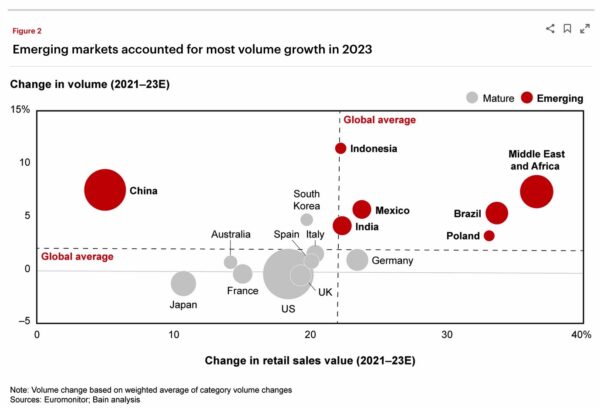

Emerging markets accounted for the vast majority of global volume gains (see Figure 2). India was a standout example of balanced growth, with RSV advancing by nearly 15% since 2022, aided by consumers switching from local or unbranded products to bigger, international brands. Volume and pricing were both under pressure in China, amid low consumer confidence.

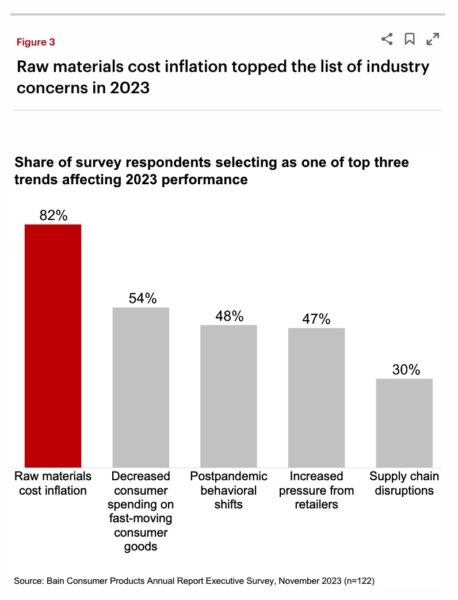

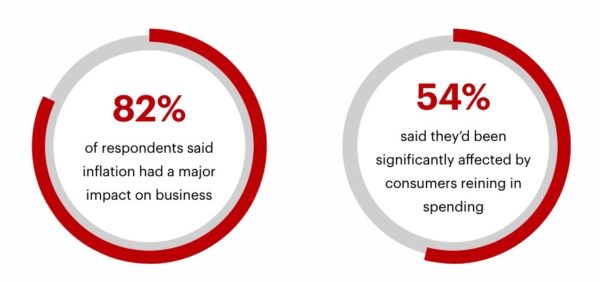

Our executive survey underlined just how much rising input costs contributed to the widespread decoupling of price and volume growth: 82% of respondents said inflation had had a major impact on their business in the previous year, which made it the biggest issue of all for executive teams (see Figure 3).

But as inflation slows, a paradox is emerging. On one hand, prices have risen too much. Consumers—asked to pay more without getting any extra benefits in return—are switching to more affordable private-label brands or to more premium insurgent brands that offer greater consumer value. They are also waiting for promotions or just buying less. Slightly more than half the executives we polled (54%) said they’d been significantly affected by consumers reining in spending in 2023.

On the other hand, prices haven’t risen enough. The leading CPGs we analyzed have increased prices by more than 20% on average since the third quarter of 2021, but that was blunted by similar growth in the cost of goods sold. For top CPGs, the average EBIT margin remains near a 10-year low (12.2% in the third quarter of 2023 vs. a high of 13% in 2020). It certainly doesn’t help that retailers have been looking to share their own margin pain with CPGs. Almost half the consumer products executives responding to our survey said increased retailer pressure significantly hit their 2023 performance.

To ease the pressure, half of top CPGs reduced headcount significantly last year or froze hiring, following ongoing SG&A cost-reduction measures. But there are only so many cost levers that can be pulled; with no room left on price, a return to volume growth will be critical.

For many CPGs, part of the answer will involve flexing their muscles in emerging markets, which offer the greatest room for volume growth (but which often demand different capabilities, too). CPGs will also need to identify critical places in which they can become simpler and cope with the additional complexity that’s on the horizon. For instance, consumers are becoming more sophisticated and less uniform. Furthermore, retail continues to fragment, geopolitical uncertainty will demand fresh supply chain investment, and category disruptions won’t be limited to Ozempic.

Against this challenging backdrop, future growth will require a fundamental reshaping of value propositions, portfolios, and business models. The biggest CPGs will already have a particularly acute sense that they are at this crossroads. While we expect that the sector overall grew about 10% in 2023, larger CPGs are only expected to have grown 4%, in a reversal of several years of outperformance. There’s no time to lose.

A widening digital gap and mounting sustainability pressure

While price/volume tension was the biggest theme of 2023, there were also clear signs of the rising importance of next-generation capabilities in digital and sustainability, which will be crucial to CPGs’ attempts to differentiate themselves and generate future growth.

Digitalization of business processes—including new capabilities as well as basic processes—has become more urgent, as performance gaps widen between CPGs that made early, focused investments and those that did not. Our analysis found that CPGs tend to reward investors more richly if they also have a high level of digital focus (e.g., an emphasis on digital in the strategic agenda, the presence of a digital leader on the executive team and board, and a greater willingness to make investment in tech a priority). Between 2018 and 2022, the total shareholder return of the CPGs that ranked in the top quartile for digital focus was about 15 percentage points higher than that of the bottom quartile.

Digital leaders will have an advantage in key areas over the coming years. They will be best placed to capitalize on vast pools of data and maturing generative AI technologies to develop both consumer-facing use cases that add revenue and internal applications that generate cost efficiencies. The gains are likely to be significant. For instance, as much as 40% of labor time could be automated in certain functions through measures such as AI-generation of ad copy variations with minimal prompting. And while leaders are moving to build differentiated capabilities, most CPGs will still need to focus significant resources on the migration to the latest ERP software.

It’s harder to quantify the gap between leaders and laggards in sustainability. But the pressure to make progress will only increase. Half of global consumers now say sustainability is one of their top four considerations when shopping and that they’d be willing to pay about 10% more for sustainable products (see the Bain report The Visionary CEO’s Guide to Sustainability). Retailers are looking for suppliers that can help them reduce their own direct and indirect emissions. Climate-related disclosure, meanwhile, is moving to a more regulated and mandatory basis in many countries, exposing companies to more intense scrutiny (see the Bain Brief “Mere Compliance Won’t Be Enough as New Climate Disclosure Rules Hit”).

Despite this broad momentum, only about a third of CPGs are on track to meet their Scope 1–3 decarbonization commitments. Our survey, meanwhile, showed only muted urgency on environmental, social, and governance (ESG) issues. While nearly two-thirds of executives who cited ESG as a priority are focused on executing on existing commitments, only 20% of respondents said ESG was a priority in 2024, and, more worryingly, only about 10% felt they were lagging CPG peers in terms of having a positive impact on the planet.

Resetting the growth agenda is undeniably the top priority for consumer products this year. But that short-term imperative still must lead to longer-term sustained growth. A balanced approach to serving all stakeholders is a powerful way of achieving those twin goals.

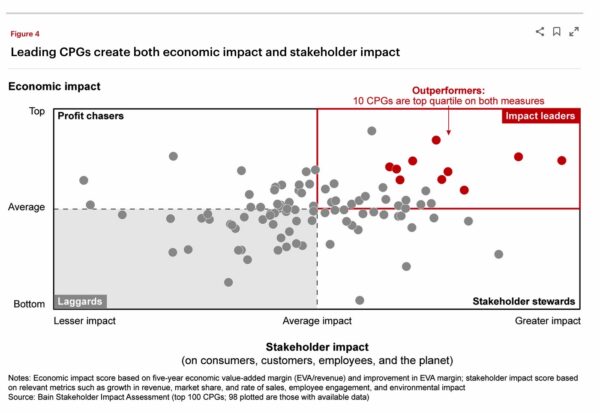

Our latest research shows that meeting the needs of four key stakeholder groups—consumers, customers, employees, and the planet—doesn’t distract top CPGs from the vital task of creating economic value for investors. On the contrary, such breadth actively supports profitable growth.

That finding comes from an analysis of the top 100 publicly listed CPGs globally (by revenue). We mapped economic impact over the past five years (based on a company’s ability to generate profit above the cost of capital) against stakeholder impact (based on metrics such as share of consumer spending, employee engagement, and environmental impact). It turned out that those scoring in the top quartile on stakeholder impact are twice as likely as other CPGs to also be in the top quartile for economic impact.

Overall, CPGs can be divided into four categories based on their ability to succeed on both fronts: impact leaders, profit chasers, stakeholder stewards, and laggards (see Figure 4). The category a CPG falls into can help to determine its longer-term strategic agenda. For instance, impact leaders need to move from outperformance to unique differentiation, rather than standing still as the regulatory and competitive landscape shifts. Profit chasers and stakeholder stewards must find a more balanced approach that succeeds across both dimensions. Laggards must fundamentally reevaluate their strategy and impact-creation plan.

For most CPGs, winning for all stakeholders in a way that drives long-term economic value will require a full transformation—a complete reshaping of the portfolio and the capabilities and organization that support it. While this isn’t simple, it can be done. Within the impact leader group, for instance, there’s a smaller band of outperformers—1 in 10 of our broader sample—that are producing top-quartile performance for both economic value creation and stakeholder impact. We’ll showcase similar success stories throughout 2024 in our consumer products CEO Spotlight interview series, which featured Procter & Gamble’s Jon Moeller in its debut installment.

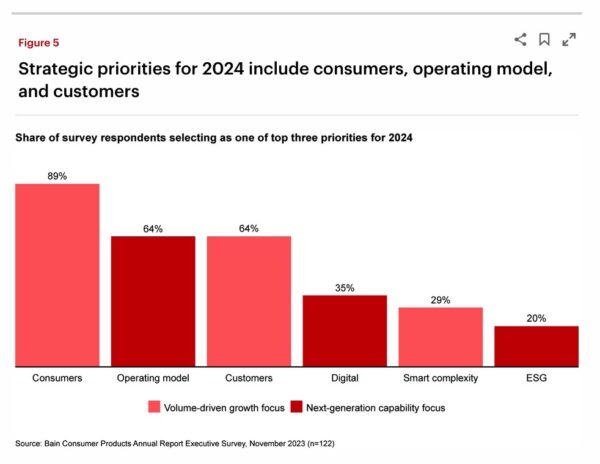

When we asked consumer products executives to rank priority areas for 2024, three stood out: consumers, operating model, and customers (see Figure 5). Digital and ESG should also be core parts of the executive agenda for the coming months. As should “smart complexity,” a phrase we use to describe striking the right balance between agility and scale, so that a company maximizes the benefits of streamlining without sacrificing resilience or responsiveness.

These six priorities fit into two overarching strategic imperatives for 2024:

- The return to profitable, volume-driven growth

- Winning over the consumer

- Winning with the customer

- Smart complexity

- The acceleration of next-generation capabilities

- The new digital agenda