Coupon Activity is +4.5% in 2013

January 13, 2014

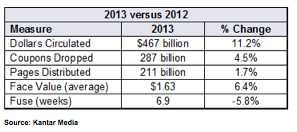

![]() Kantar Media reports that more than 287 billion Free Standing Insert (FSI) coupons were distributed in 2013, a 4.5 percent increase in activity compared to 2012. This represented a distribution of $467 billion in consumer incentives, an 11.2 percent increase over the prior year. Average Face Value also increased to an all-time high of $1.63, representing a 6.4 percent increase over a year ago.

Kantar Media reports that more than 287 billion Free Standing Insert (FSI) coupons were distributed in 2013, a 4.5 percent increase in activity compared to 2012. This represented a distribution of $467 billion in consumer incentives, an 11.2 percent increase over the prior year. Average Face Value also increased to an all-time high of $1.63, representing a 6.4 percent increase over a year ago.

“These trends indicate that FSI coupons continue to be an effective tool to deliver purchase incentives for consumers. Advertisers are clearly seeing the value of the FSI vehicle evidenced by the growth in Pages Circulated: FSIs now reach an average of more than 70 million households per week,” said David Hamric, General Manager, Kantar Media Marx.

Overall FSI Activity Grows

During 2013 more than $467 billion in consumer incentives were delivered via FSI coupons, up 11.2 percent from 2012. This increase in incentives was driven by more than 287 billion coupons distributed in more than 211 billion FSI pages. Average Expiration (Fuse) continued a steady downward trend with a decrease to 6.9 weeks, down 5.8 percent versus a year ago. These trends indicate that manufacturers are increasing consumer incentive with more coupons and higher Face Values in the market place but are managing their financial exposure by shortening the length of time that these offers are available.

In 2013, the “pre-Super Bowl” promotion week of January 27th had the greatest activity with an average circulation of 111 pages. The “New Year” promotion week of January 6th had the second highest level of activity with an average of 105 pages and the beginning of “Back-to-School” promotion week of July 28th was the third most heavily weighted week with a total average of 101 pages.

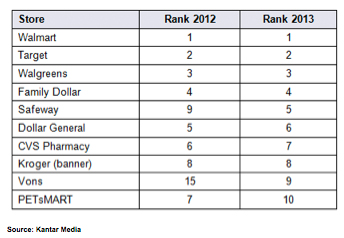

Top Retailers Increase Pages Circulated

Retailer promotion pages grew by 25.6 percent and accounted for more than 22.9 billion pages in 2013, fueled in part by significant increases from a few major players. (The overall number of retailers using FSIs actually decreased slightly from 2012 to 2013, while manufacturers held steady.) Walmart retained the top spot with a 29.5 percent increase to 7.6 billion pages. Target continued to hold the second spot with a 91.8 percent increase to 4.7 billion pages and Walgreens maintained the third spot with a 49.2 percent increase to 3.7 billion pages. Vons and Safeway had the largest changes in rank within the top 10, with Vons up 6 spots to 9 and Safeway up 4 spots to 5.

Seven out of nine product categories increased or remained flat with Pages Circulated by retailers, including Refrigerated Foods (up 55.6 percent), Health Care (up 37.8 percent) and Personal Care (up 21.9 percent). “With Retailer Pages increasing in the double digits, it’s clear that retailer alignment is a critical factor in consumer promotion,” said Hamric. “FSIs are an important advertising vehicle for retailers because they reach shoppers in the home while they are preparing shopping lists and planning their shopping trips. Accordingly, it’s crucial for manufacturers to work with retailers to enhance their traditional coupon offerings.”

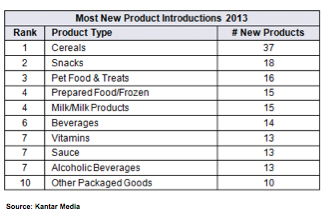

New Product Activity Increases

During 2013 there were 412 new products that delivered FSI coupons across 814 event dates as part of their introduction campaigns, averaging 2.0 event dates per new product. This reflects an increase over the 348 new products in 2012, although with 727 event dates these new products averaged a slightly higher 2.1 event dates per product. Cereals had the greatest number of new products in 2013 with a total of 37.

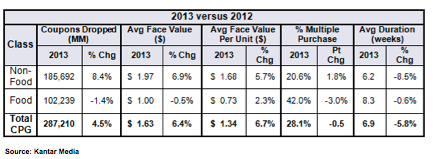

CPG Non-Food vs. Food

In 2013, Non-Food categories distributed more than 185 billion coupons, up 8.4 percent versus a year ago, driven by the 14.1 percent increase within the Personal Care area. Food categories distributed more than 102 billion coupons, representing a decrease of 1.4 percent, led by the 4.0 percent decline for the Dry Grocery area. Six of the nine areas defined by Kantar Media reported increases or remained flat in Coupons Dropped during this period. Frozen Products, Other Packaged Goods and Personal Care areas all posted double digit increases in 2013, up 11.8 percent, 27.6 percent and 14.1 percent respectively.

Manufacturers are increasing the value of the offers being delivered to consumers in the Non-Food segment while remaining flat in the Food segment. Weighted Average Face Value (WAFV) for Non-Food increased 6.9 percent to $1.97 and was combined with a 1.8 point increase in Multiple Purchase Requirements (MPR) resulting in 5.7% growth in Weighted Average Value per Unit (WAFVPU) to $1.68. WAFV for Food was flat, down 0.5 percent to $1.00 and was combined with a 3.0 point decrease in MPR resulting in WAFVPU increasing 2.3 percent to $0.73. These promotion tactics are designed to increase the number of products the consumer purchases per coupon to potentially increase brand loyalty or preempt competitive purchasing for a longer period of time.

Courtesy of Kantar Media