Five Consumer-Declared Trends Shaping Hispanic Holiday Shopping This Year

November 4, 2025

The CivicScience database of one million daily consumer-declared responses reveals five key points to know about the American Hispanic consumer as holiday shopping begins to ramp up:

1. More spending, more gifts, and more BNPL

Hispanic American holiday shoppers are far more likely to plan on spending ‘more’ on the holidays this year compared to last (43%) than they are to say they’ll spend ‘less’ (25%). But this increase in spending isn’t just the result of higher costs and tariffs—an additional survey finds they’re also much more likely to plan on buying ‘more’ gifts this year, too.

With this intent for increased spending comes a coinciding percentage of Hispanic holiday shoppers who tell CivicScience they are more likely to use Buy Now, Pay Later services for holiday shopping this year (45%), compared to last year. Just 23% say they are less likely to use BNPL this year.

2. How, where, and the critical factors that will shape Hispanic American holiday shopping

In-store looks to lead as more than two in five (42%) of Hispanic American shoppers say they’ll do less than half of their holiday shopping online this year; an exact contrast of the 42% of non-Hispanic shoppers who will do +50% of their shopping online. Big box shopping is most common; however, Hispanic shoppers over-index non-Hispanic shoppers in intent to shop at dollar stores, department stores, and specialty/chain stores by five percentage points each.

Although these consumers will lean heavily toward in-store shopping, there are still online factors to emphasize when looking to reach these shoppers before they buy. Deals and free shipping are the top determining factors, although Hispanic holiday shoppers are notably more likely to prioritize Buy Now, Pay Later options, expedited shipping, and curbside pickup as they choose where to shop this year.

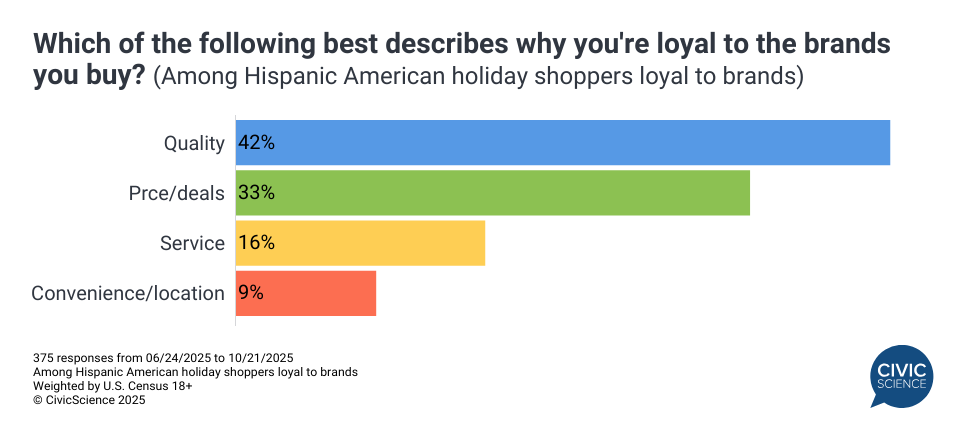

3. Quality drives brand loyalty

Hispanic American holiday shoppers are quite loyal to their favorite brands, as 84% say they’re at least ‘somewhat loyal’ and 3 in 10 report they are ‘very’ loyal to their favorite brands. When asked why they’re loyal to the brands they buy, the plurality (42%) cited ‘quality,’ outpacing ‘price and deals’ by nine points and other factors such as service and convenience by nearly 30 points.

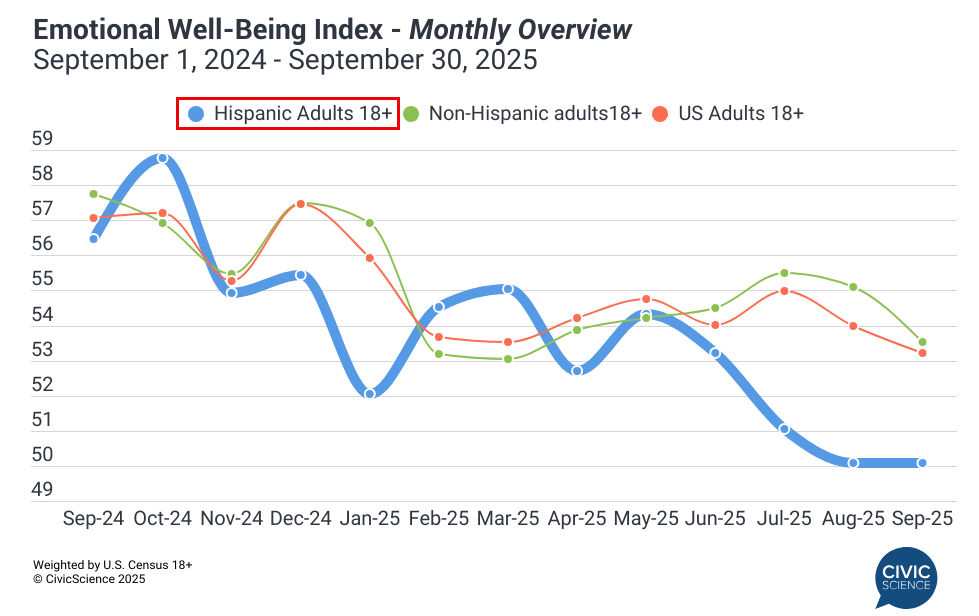

In recent months, Hispanic Americans have continued to report lower well-being. The CivicScience Well-Being Index (WBI) through the end of September reveals Hispanic American well-being hovering around its lowest point in more than four years—significantly lower than that of non-Hispanic Americans and Gen Pop overall.

This is culminating in higher holiday spending among Hispanic shoppers. For example, 62% of Hispanic holiday shoppers report at least somewhat strong feelings of stress (a core component of the WBI) over the past week, and they are far more likely to say they’re spending ‘more’ on holiday shopping this year (37%) than they are to spend less (25%). It’s a similar story among those experiencing feelings of fear, where those spending more (38%) again outpace those spending less (26%).