Millennials Make 2015 the Year of the Milestone

February 3, 2015

It’s been widely reported that for many Millennials, “30 is the new 20,” with many delaying major life milestones, like full-time employment, marriage and having children. However, recent data from the American Express Spending & Saving Tracker suggests that as the economy continues to recover, Millennials will make 2015 a year of major purchases and life experiences.

It’s been widely reported that for many Millennials, “30 is the new 20,” with many delaying major life milestones, like full-time employment, marriage and having children. However, recent data from the American Express Spending & Saving Tracker suggests that as the economy continues to recover, Millennials will make 2015 a year of major purchases and life experiences.

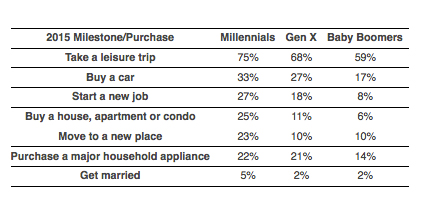

With the generation becoming a little older and perhaps wiser, Millennials, defined as young adults age 18-34, say they’re more likely than older generations to experience major life milestones in 2015 (56% vs. 33% Gen X, 20% Baby Boomers) and make a big ticket purchase, like a new home or car (59% vs. 43% Gen X, 34% Baby Boomers)

“For the last several years, we’ve heard a great deal about Millennials being held back by the recession,” said David Rabkin, Senior Vice President of Consumer Lending Products, American Express. “Now, with an improving economy, the country’s 80 million Millennials say they will be wielding their wallets, a trend that will create an interesting new dynamic for retailers.”

This year, Millennials are more likely than their older counterparts to:

Other Key Findings: Consumers Stash Less in the Savings Account, More in the Shoebox

For Americans of all generations, 2015 may be a good year, with more consumers feeling optimistic about their future finances (43% vs. 40% in 2014, 35% in 2012). Saving money still remains the top New Year’s resolution (58% vs. 33% in 2013), but the average amount Americans plan to save is slightly down from last year ($11,292 vs. $12,464 in 2014).

With savings goals slightly down, consumers will look to a variety of ways to get there:

- Save from primary income (52%, on par with 2014)

- Save tax returns (26%, on par with 2014)

- Pare back on little luxuries, such as morning lattes and manicures (23% vs. 21% in 2014)

- Deductions from paycheck (21% vs. 18% in 2014)

- Selling unwanted possessions online (20% vs. 18% in 2014)

A majority consumers say they’ll keep their savings at a local bank (57% vs. 55% in 2014) but more than half of those who keep their savings in cash plan to hide bills in a secret location at home (53%).