Nielsen Portable People Meter AM/FM Radio Audiences: Significant Growth in Drive Times, Weekends, and Younger Demographics; Format Shares Are Stable

March 13, 2025

Nielsen has released all January 2025 Nielsen Portable People Meter markets (except for West Palm Beach). There are significant increases in listening across demographics and time periods.

This audience growth is due to Nielsen’s three-minute qualifier modernization which provides a significantly more comprehensive and realistic definition of AM/FM radio’s audience and their listening behavior.

Nielsen found 23% of PPM listening occasions were three or four minutes. Under the old five-minute listening qualifier rule, none of this tuning would have received listening credit. Effective with the January 2025 PPM survey, Nielsen is now crediting tuning occasions that are three minutes or greater.

Westwood One’s legendary VP of Research Scott Anekstein conducted an analysis of the January 2025 PPM data, which aggregated all average quarter-hour audiences from 47 markets to get a macro view of the first survey with the enhanced three-minute reporting. Scott compared the most recent data with January 2024 and October 2024 PPM audiences.

Here are the key findings:

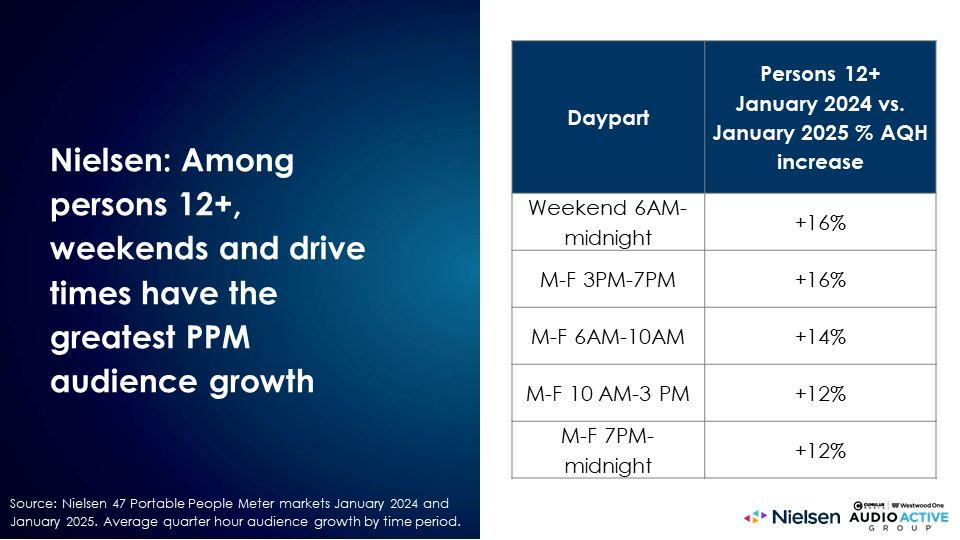

Drive times and weekends experience the greatest growth

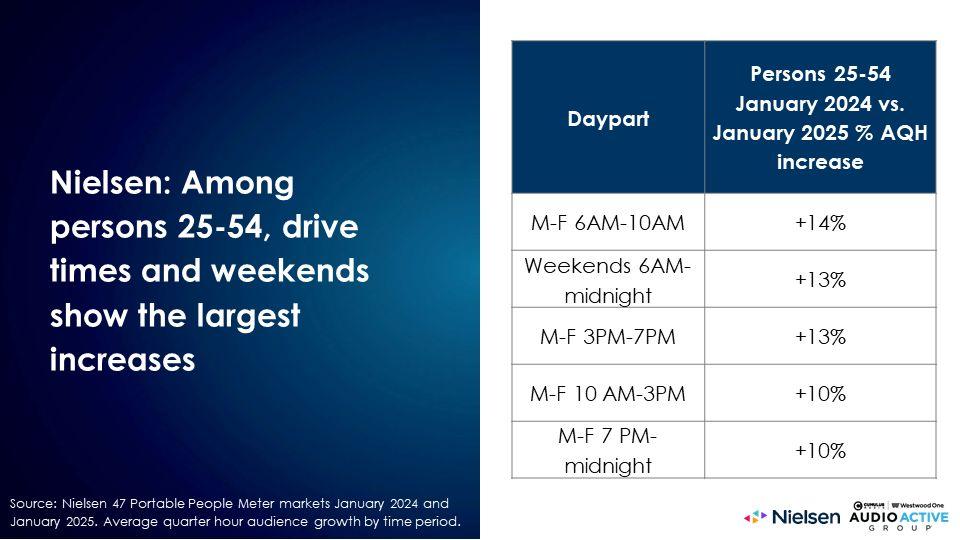

Comparing January 2024 to January 2025 for persons 12+ and 25-54 reveals double-digit growth for all dayparts. Weekends and drives times have the greatest increases.

Among persons 12+, weekends and drive times have the greatest PPM audience growth

Among persons 25-54, drive times and weekends show the largest increases

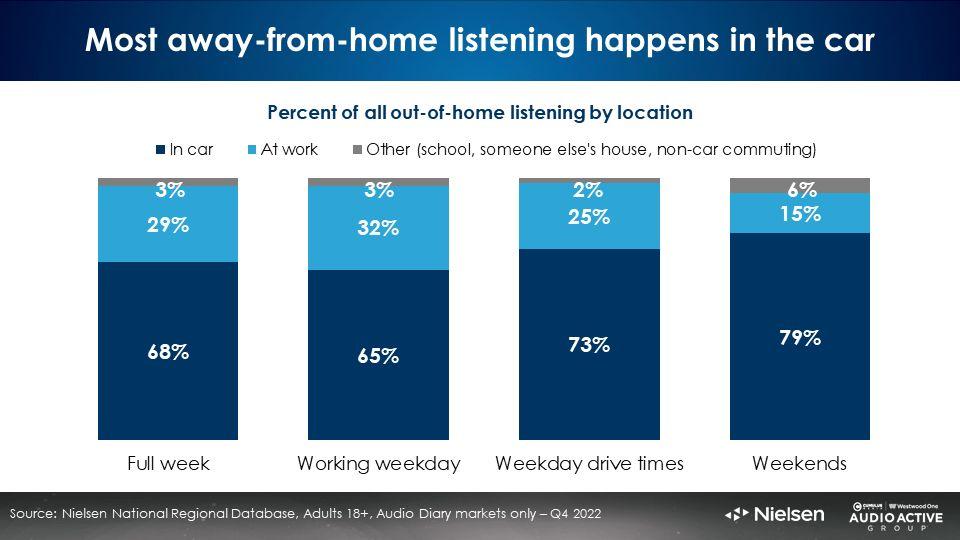

Why do drive times and weekends show the strongest audience growth with the PPM three-minute modernization?

Most likely because weekends and drive times have the highest proportion of in-car time spent where shorter occasions of listening are more common. The nature of running errands, shopping, dropping kids off at school, and attending kids’ activities means shorter occasions of listening. These three- and four-minute occasions of listening are now being credited.

In their diary markets, Nielsen reports that in-car listening represents the majority of away-from-home listening. The dayparts with the most significant proportion of out-of-home listening in-car are weekends (79%) and drive times (73%).

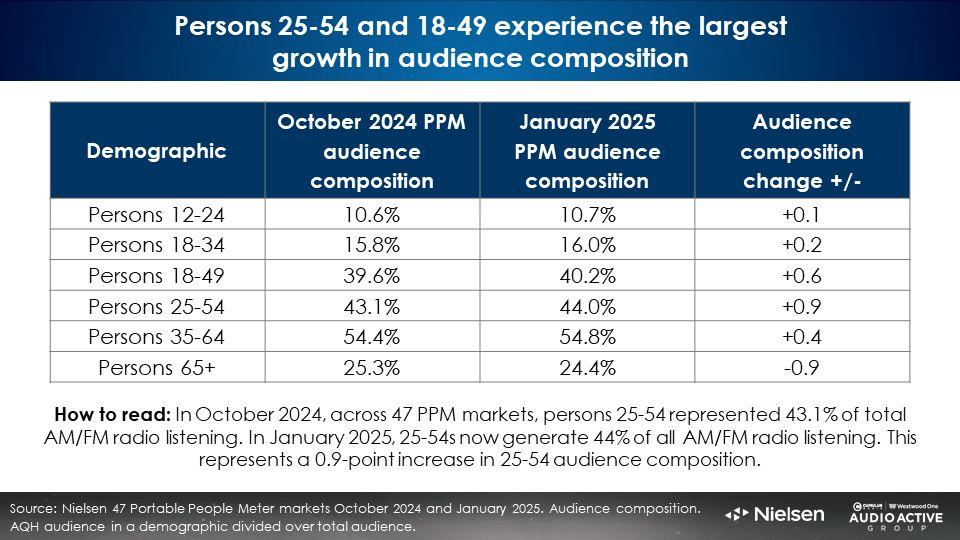

AM/FM radio’s listening profile now skews younger: Every major buying demographic has a higher composition of listening

Persons 65+ is the only demographic where AM/FM radio’s audience composition is reduced. Persons 25-54, AM/FM radio’s most popular buying demographic, experiences the largest increase in audience composition. Persons 18-49 have the next largest growth.

Persons 25-54 and 18-49 experience the largest growth in audience composition

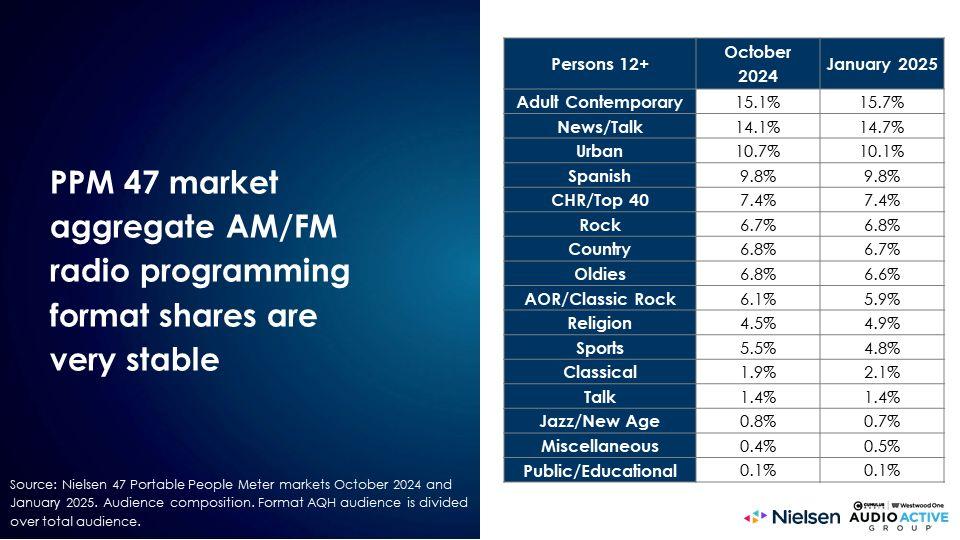

Format shares remain stable

Versus October 2024, PPM January 2025 format shares are very consistent. Across the 47 PPM markets, most formats maintain shares within a few tenths. AC is up 0.6. Urban is down 0.6

An uptick in News/Talk AQH composition is most likely more due to a heavier news cycle (major weather stories and a new president) than a PPM methodology enhancement. In local markets, there is more share variation.

Nielsen Nationwide: Total U.S. AM/FM radio listening is up +3%

Network radio advertisers transact on Nielsen’s national audience service called “Nielsen Nationwide.” Scott Anekstein also conducted a national AQH analysis utilizing the latest January 2025 PPM markets and the existing diary markets from last year. (PPM metro markets represent over a third of total U.S. AQH (35% P12+) and over half of total U.S. population (53% P12+).)

Anekstein combined Nielsen’s PPM AQH audiences from January 2025 markets (with the new three-minute edit rule) with diary audiences from the Spring 2024 Nationwide survey. (The new Fall 2024 Nationwide study releases within a week.)

Comparisons with the reprocessed data showed:

- Overall, 18-49 total U.S. AQH listening grew +2%.

- Persons 25-54 total U.S. AQH listening grew +3%.

For national marketers, top market indices increase because of the PPM three-minute listening qualification

Network radio advertisers often assess the proportion of impressions that are generated by the largest markets. PPM markets have always had lower listening levels than diary markets due to the more exact nature of the Portable People Meter listening capture.

AM/FM radio audience growth in the PPM markets has increased the proportion of top market listening. In October 2024, the PPM markets represented 36% of total 25-54 U.S. AM/FM radio listening. In January 2025, the PPM markets generated 38% of American persons 25-54 listening.

Previously, 25-54 listening levels in the top 50 markets were -19% lower than the total U.S. This is due to the fact the PPM method represents the vast majority of AM/FM radio listening in the top 50 markets.

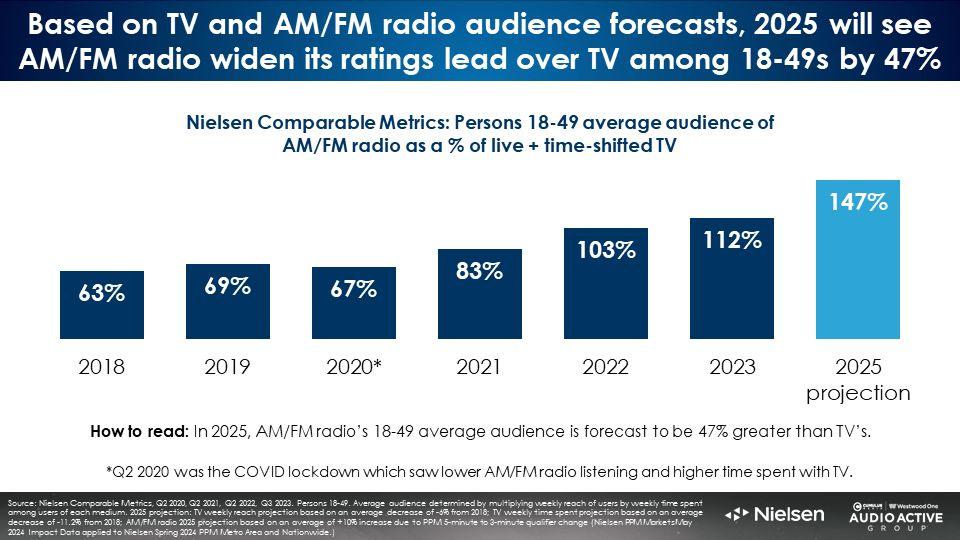

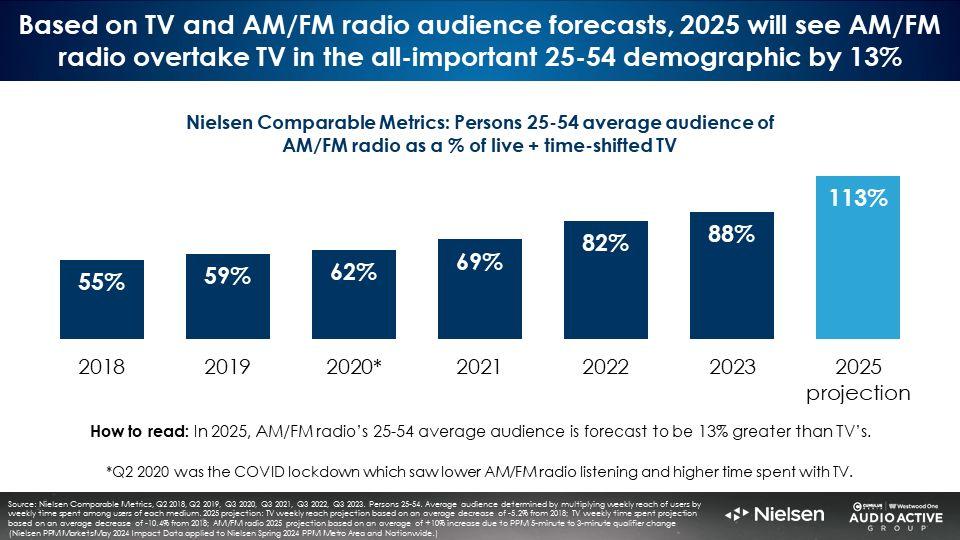

Four implications of PPM listening increases

1. The trend of AM/FM radio surpassing TV in ratings will accelerate: Over the last five years, AM/FM radio has overtaken linear TV in ratings. As of 2023, AM/FM radio’s 18-49 ratings were 12% greater than TV. Among 25-54s the gap between TV and AM/FM radio ratings has been steadily closing. Based on TV and AM/FM radio audience forecasts, 2025 will see AM/FM radio overtake TV in the all-important 25-54 demographic and widen its ratings lead over TV among 18-49s.

2. 2025 post-buy analyses will overachieve 2024 media plans: In PPM markets, expect increases in audience deliveries based on prior year schedules. For local buys, outcomes will vary by demographic, markets utilized, and AM/FM radio programming format mix.

For total U.S. media plans using Nielsen’s Nationwide survey, deliveries will grow by low single digits. Differences will result due to the mix of diary versus PPM market composition in network lineups as well as AM/FM radio programming format mix. The first impact of the PPM three-minute modernization qualification for the Nielsen Nationwide service will occur in September 2025 when the Spring 2025 Nationwide survey is released.

3. AM/FM radio, already America’s number one mass reach media, will experience reach growth in advertising schedules: With PPM now reporting higher AM/FM radio reach levels, campaign reach will experience growth. Since reach is the foundation of advertising effectiveness, this is a positive for AM/FM radio’s performance in media mix modeling analysis.

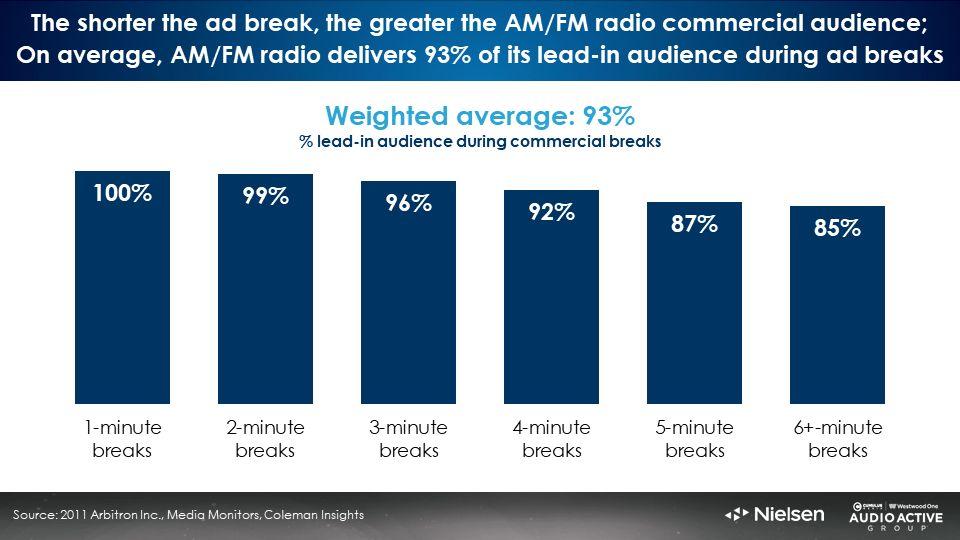

4. AM/FM radio ads will become more effective as stations increase the number of commercial breaks with shorter durations: Since the introduction of the Portable Meter, most AM/FM radio stations schedule their two commercial breaks around 15 and 45 minutes past the hour. This strategy was designed to maximize five-minute listening durations.

With a three-minute quarter hour qualification, stations can create more breaks of shorter duration. This will significantly benefit advertisers.

A massive Portable People Meter study of 17,896,325 unique commercial breaks involving 61,902,473 minutes of advertising conducted by Nielsen, Media Monitors, and Coleman Research reveals the shorter the ad break, the greater the audience retention.

Two-minute ad breaks retain 99% of the lead-in audience. Six-minute ad breaks retain 85% of the lead in audience.

Creating more ad breaks of shorter duration generates larger commercial audiences. Advertisers stand out more in shorter breaks. Growing audience deliveries for AM/FM radio ads improve AM/FM radio’s performance in media mix modeling and marketing effectiveness studies.

Key findings from the first survey with Nielsen’s three-minute qualifier modernization:

- Weekends and drive times have the greatest PPM audience growth

- AM/FM radio’s listening profile now skews younger: Every major buying demographic has a higher composition of listening

- Format shares remain stable

- Nielsen Nationwide: Total U.S. AM/FM radio listening is up +3%

- For national marketers, top market indices increase because of the PPM three-minute listening qualification

Four implications of PPM listening increases

- The trend of AM/FM radio surpassing TV in ratings will accelerate

- 2025 post-buy analyses will overachieve 2024 media plans

- AM/FM radio, already America’s number one mass reach media, will experience reach growth in advertising schedules

- AM/FM radio ads will become more effective as stations increase the number of commercial breaks with shorter durations

Pierre Bouvard is Chief Insights Officer of the Cumulus Media | Westwood One Audio Active Group®.