Peaks and valleys: Ad spending trends around the world

April 25, 2024

Where should I advertise and when? This is probably one of the most frustrating questions in the marketing book.

Today as always, every company must carefully study its markets, decide where to allocate its media budget, and measure the performance of its campaigns. But the time window to do those things has compressed considerably. Consumers are more volatile. Competition is stiff. New channels keep emerging, and economic conditions change faster and are harder to predict.

That’s why it’s so crucial for marketers to use the right data to guide their spending decisions. And one set of data that often gets overlooked in media planning is competitive advertising intelligence: reliable, granular data that comes from monitoring detailed ad spend from all the major players—industry by industry, country by country, month after month. The insights can be invaluable to inform strategy, identify new opportunities and outmaneuver rivals.

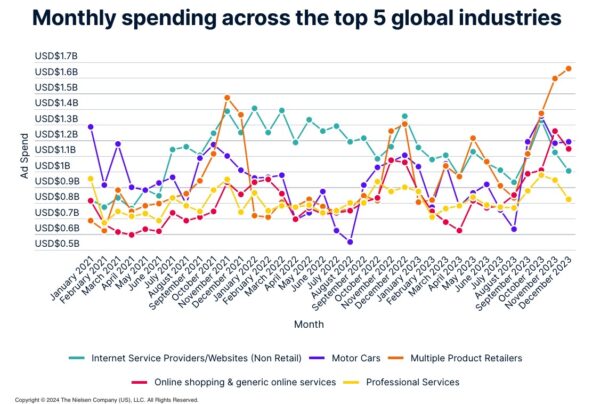

Let’s review ad spending trends across the five largest product categories around the world.

Ad spending trends by category

The holiday season is the busiest spending time for nearly all of the five largest. The data supports the general consensus that if there’s a time to advertise, it’s in November and December, when consumers do the bulk of their holiday shopping. But that doesn’t mean that they don’t run any advertising the rest of the year.

There are sales to support throughout the year, of course, as well as long-term brand building efforts. Drafting off the heights of November and December, October is proving to be an equally valuable month. This is when spending was at its highest last year for internet service providers (like Netflix, Google, and Virgin Media), professional services (like law, accounting and IT consulting), and the auto sector.

Of the top five categories, the two with the largest investments shifts month to month are auto and multi-product retailers. Auto sector spend tends to be at its lowest in August and, in addition to the holiday season push, has a consistent bump in March. Whereas in the retail category, spend is relatively low with spikes during the holidays and between March and May.

Now let’s explore how these trends shift when you drill down to the country level.

Ad spending trends by country

When digging into investment trends at the country level, we see just how much product categories differ. For example, between 2021 and 2023, Internet Service Providers spent considerably more in Mexico and a notably smaller amount in Italy, especially when compared to other European countries. Broadcasters, on the other hand, spent more in Indonesia, and the bulk of investment for the Calling Services and Networks category was in the U.K.

Why is it important to know when spikes and drops in ad spending tend to occur in your industry and how it shifts across countries? Because you don’t want to ignore critical time periods when your consumers are out shopping, but also because you might be able to find off-peak opportunities to stand out, perhaps in a different market, on a different channel and at a better CPM. Whether you ultimately decide to go with or against the flow, you’re better armed with a full understanding of your competitors’ activity.

What these trends mean for marketers

There are two important takeaways. One is that media markets around the world are at various stages of development, and there’s no assurance that they will converge to a single picture anytime soon. Are you investing in the right markets at the right time? Are your campaigns set up to cut through the noise or capitalize on your competitor’s inactivity? There’s no need to make fatal assumptions when these insights (and more) are available.

The second is that with the right data intelligence partner, you can dive in and learn what your local competitors’ favorite channels are or what their creative sounds like, much like we showed across category spending peaks at the country level. This can help you find holes in their positions and optimize your own media strategy.