Understanding how audiences connect with news media ahead of the 2024 U.S. elections

March 8, 2024

2024 is predicted to be a record-setting year for political ad spending in the U.S., according to eMarketer forecasts. And advertisers—especially those leading political campaigns—will need to understand how voters are consuming media and how things may have changed since the last elections. With political campaigns buying up valuable ad inventory in the U.S., all advertisers can benefit from understanding how audiences stay connected as ad prices rise, especially on news programming.

While prices may be higher, the extra spending could pay off even for non-political advertisers. News programming typically sees a boost in viewership during election years. U.S. News viewership in 2020 was extraordinarily high due to COVID coverage, social unrest and a tight election. But even during the mid-year election in 2022, both broadcast and cable news programming saw audiences spending more time with news than the non-election years 2021 and 2023.

Time spent with news differs across demos

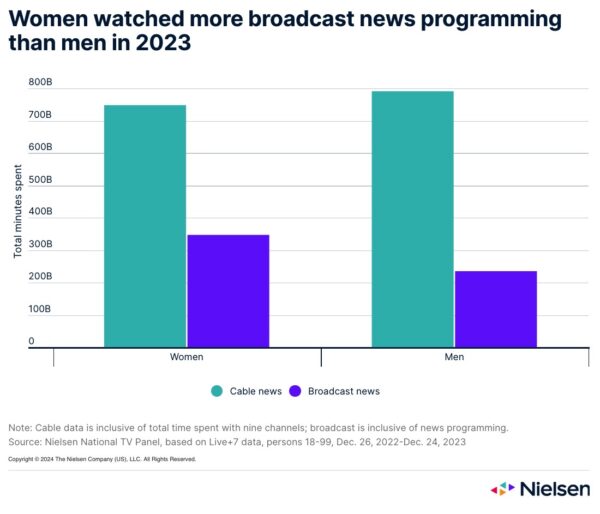

Understanding consumption habits can help you reach the right audiences on the right media. With 24-hour news programming, it’s not surprising that Americans spent more time with cable news than broadcast news in 2023. When we look at total time spent by gender, both genders follow the trends for the population as a whole. However, while men watched slightly (5.7%) more minutes of cable news than women, women watched 47.7% more minutes of broadcast news than men.

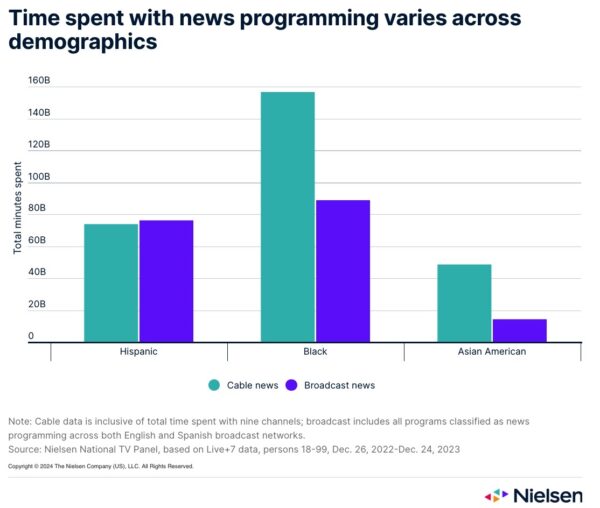

Black viewers spend the most time with TV in general, including news programming, well ahead of Hispanic and Asian viewers. Both Black and Asian viewers follow the general population pattern, spending more time with cable news programming than broadcast. In this, Hispanic viewers are the outlier, spending slightly more annual minutes with broadcast news than cable. Advertisers looking to influence women and Hispanic voters shouldn’t overlook the power of traditional broadcast news.

News programming access is expanding

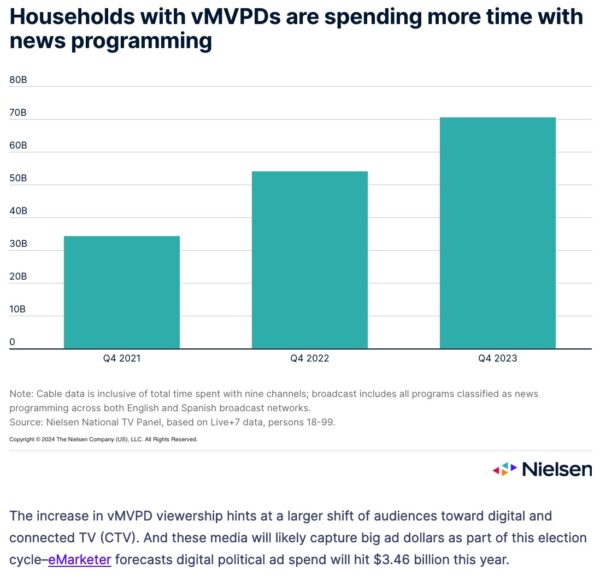

How viewers are accessing both broadcast and cable is changing. Americans are increasingly using over-the-air (OTA) and over-the-top (OTT) devices, including virtual multichannel video programming distributors (vMVPDs), such as YouTubeTV, Sling TV and Hulu+ Live TV, to access TV programming. Household vMVPD subscriptions have increased year-over-year for the last three years, growing from 12.1% of all U.S. TV households in December 2021 to 16.5% in December 20231. And news viewing on vMVPDs follows a similar trend.

The right media mix is critical to reach voters

To better understand digital trends, we used our Scarborough consumer insights to study how people affiliated with different political parties use the internet or apps to consume video content. Reaching independent voters will be critical for political campaigns eager to earn votes from undecided audiences. And understanding how they report connecting to digital video content can make sure marketers reach them in the right places.

Those who consider themselves to be independent but say they align closer to the Democrat party are 15% more likely than the average U.S. adult to watch technology news video content on the internet or apps2. Beyond news content, these respondents were 17% more likely to watch cartoon videos. Meanwhile, those who consider themselves independent but say they align closer to the Republican party are 15% more likely than the average U.S. adult to watch business news on the internet or apps. Outside of news, they’re 13% more likely to watch sports videos.

But with Google’s depreciation of cookies in the second half of this year, all advertisers will likely have a harder time reaching the right audiences on digital media. This could cause marketers to shift their ad dollars, including political ad dollars, toward publishers with their own robust first-party data. The programmatic power of CTV is enticing to marketers, but reach is far more complicated in CTV than linear TV because of the commingled nature of the platform and campaign IDs in measurement data. Through that lens, it’s not surprising that only 31% of global marketers say they’re very confident in measuring the ROI of their CTV investments3.

For political marketers, adding radio to the marketing mix could offer valuable incremental reach opportunities for campaigns. Nielsen recently conducted a study of 2022 political campaigns using Nielsen Media Impact. In the competitive 2022 Pennsylvania Senate race between Dr. Mehmet Oz and John Fetterman, we found that, by allocating one-fifth of the ad budget to AM/FM radio, the Fetterman campaign was able to deliver a 12% bump in audience reach without increasing spend. With radio’s hyper local listenership, tailoring messaging—and media placements—to the city level can help advertisers reach key demographics.

2024 will present challenges for political and non-political advertisers alike to reach audiences across media. Better understanding how audiences are consuming news content can help them navigate this fragmented landscape successfully. And being creative in your cross-media mix can help drive incremental reach with key audiences.

Source

- Numbers based on Nielsen’s panel penetration. Nielsen began producing households with a vMVPD Universe Estimate (UE) in July 2023. That UE has increased month-over-month, growing from 15.9% in July 2023 to 16.4% in February 2024.

- Includes types of video content streamed from the Internet on a computer (laptop or desktop), mobile device (smartphone or tablet) or Internet connected device (such as Roku, smart TV, game console, etc.) in the past 30 days.

- Nielsen Annual Marketing Report, 2024.