US Retail Sales Up 2.9% in August, But Ad Spending By Retailers Likely Up ~5%

September 16, 2023

By Brian Wieser

Retail sales data historically took on outsized importance in the imaginations of practitioners within the advertising industry. Advertising by retailers has never been unimportant – spending on advertising by retailers, including food services and drink places amounts to 20% of total advertising expenditures in the United States, according to the most recently available data from a sample of tax returns included in IRS data. But as a percentage of economy-wide receipts, these businesses only account for 17% of all turnover.

None of that is to take away the fact that there is important data related to consumer spending and advertising conveyed in the monthly data which is provided by the US Census Bureau, and in fact, retail data is important for reasons that probably aren’t widely appreciated: the most ad-intense sub-sectors of retailing are growing faster than less ad-intense sub-sectors.

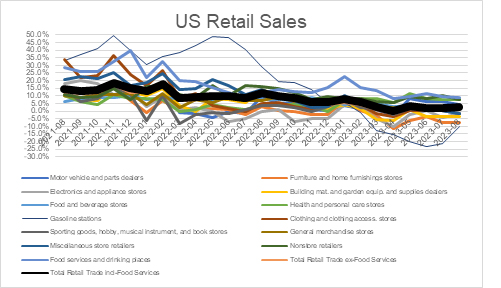

Reviewing the latest data from the US Census Bureau, released today, shows that total retail sales including food services grew on a year-over-year basis by 2.9% in August. Overall growth was 2.0% excluding food services. Although inflation was a distorting factor, this growth occurred on top of year-ago comparables of 11.6% and 11.5%, respectively, and is essentially in line with “normal” retail sales growth trends from recent pre-pandemic years.

Source: US Census Bureau, Madison and Wall

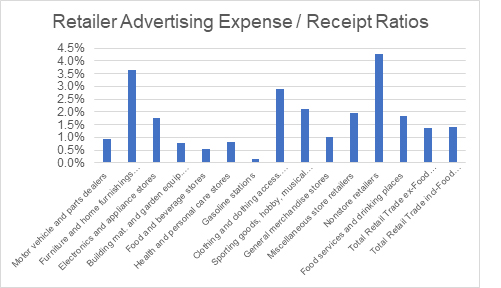

More importantly for those looking to the data for advertising read-throughs, note that non-store retailers – mostly e-commerce – grew by 7.6% in August. While retailers typically spend 1.4% of total receipts on advertising, according to IRS data, non-store retailers – now 16% of total retail – spend 4.3% of their receipts on advertising. Additionally, food services, which account for 13% of the broad definition of retailer, also over-indexes as an advertising category at 1.8% of receipts going into advertising, and food services continue to grow rapidly, with 9.1% revenue growth year-over-year.

Source: IRS, Madison and Wall

Overall, the more ad-intense categories of retail are generally outpacing those which are declining, such that if advertising expense ratios held constant over time, we could calculate 5.1% growth in advertising expenditures from retailers as a whole during August despite the aforementioned 2.9% growth in receipts.